Wool, Lambs, Sheep Eligible for CFAP 2 Payments

American sheep and wool producers will see direct benefits from a second round of Coronavirus Food Assistance Program payments that were announced today by President Donald J. Trump and Secretary of Agriculture Sonny Perdue.

“The American Sheep Industry Association had been assured by officials from the U.S. Department of Agriculture that a second round of CFAP funding was coming, and that America’s sheep and wool producers would be eligible for payments through the additional funding,” said ASI President Benny Cox.

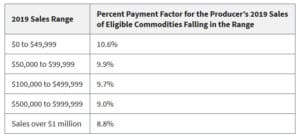

CFAP 2 payments are available for eligible producers of wool, which is categorized as a sales commodity. Payment calculations will use a sales-based approach, where wool producers are paid based on five payment gradations associated with their 2019 sales.

Payments for wool will be based on the producer’s 2019 sales of eligible commodities in a declining block format using the following payment factors, and will be equal to:

- The amount of the producer’s eligible sales in calendar year 2019, multiplied by

- The payment rate for that range.

Payments for wool producers who began farming in 2020 and had no sales in 2019 will be based on the producer’s actual 2020 sales as of the producer’s application date. Eligible sales only include sales of raw commodities grown by the producer. The portion of sales derived from adding value to the commodity, such as processing and packaging, and from sales of products purchased for resale, is not included in the payment calculation.

For lambs and sheep, payments will be equal to:

- The producer’s highest owned inventory of eligible lambs and sheep – excluding breeding stock – on a date selected by the producer from April 16, 2020, through August 31, 2020,

- Multiplied by the payment rate of $27 per head

Payments will be made from an additional $14 billion set aside for agricultural producers who continue to face market disruptions and associated costs because of COVID-19. Signup for the second round of Coronavirus Food Assistance Program will begin Sept. 21 and run through Dec. 11, 2020.

There is a payment limitation of $250,000 per person or entity for all commodities combined. Applicants who are corporations, limited liability companies, limited partnerships may qualify for additional payment limits when members actively provide personal labor or personal management for the farming operation. In addition, this special payment limitation provision has been expanded to include trusts and estates for both CFAP 1 and 2.

USDA’s Farm Service Agency will be hosting a producer education webinar on the second round of CFAP funding on Thursday, Sept. 24, at 3 p.m. eastern time.

Click Here to register for the webinar.

Click Here for more information on CFAP for wool.

Click Here for more information on CFAP for sheep.

Source: USDA

LDP Rates High in Several Graded Wool Categories

While many growers have already filed for the ungraded Loan Deficiency Payment, as reported prices change, so does the payment amount. This could be worthwhile for wool producers to monitor on the ASI website.

This week, for instance, the effective repayment rate on graded wool finer than 18.6 micron is now $3.20 per clean pound. This means, this week, a producer can claim a 68-cent LDP in that graded micron range, if they still have beneficial interest and meet other requirements. The repayment rate for 18.6- to 19.5-graded micron is 2.77 per clean pound – good for a 61-cent LDP. There’s also an LDP (43 cents per clean pound) available on graded wools from 19.6- to 20.5-micron.

LDPs are also available – as they have been in recent months – on the coarsest graded wools: 69 cents per pound for wools in the 26- to 28.9-micron range and 55 cents per pound for wools 29 micron and above. A 30-cent LDP is also still available for ungraded wool.

Click Here to learn more and check current rates.

Ag Groups Call for Congressional Support of CCC

The American Sheep Industry Association signed on to a letter from dozens of agriculture groups this week urging both U.S. Senate and House leaders to provide the U.S. Department of Agriculture’s Commodity Credit Corporation with additional funding as necessary to support American farmers and ranchers.

“For decades, CCC has been regularly replenished to fund programs integral to the farm safety net that Congress has worked tirelessly to craft,” read the letter to majority and minority leaders in the House and Senate. “Producers count on programs like Agriculture Risk Coverage, Price Loss Coverage, Dairy Margin Coverage, Marketing Assistance Loans, conservation programs, and many others as they provide food, fuel and fiber for our nation. Without immediate CCC reimbursement, payments and programs would be significantly delayed, jeopardizing operations across the country.

“More than ever, farmers and ranchers need the certainty and support provided by farm programs. Low commodity prices, unjustified retaliatory tariffs, natural disasters and a global pandemic have placed a tremendous burden on farm country. USDA’s most recent farm income projections forecast that cash receipts will be at their lowest level in more than a decade. Coupled with rising farm debt and a decrease in working capital, producers face challenges not experienced in decades.

“As the industry continues to endure hardships during this unprecedented time, we urge you to include CCC reimbursement in a continuing resolution. Thank you for your consideration and continued efforts on behalf of American agriculture.”

Archived Heritage Breed Sheep Webinar Available

An archived version of the latest Let’s Grow Program-sponsored webinar: The Conservation and Comeback of Heritage Breed Sheep is now available on the American Sheep Industry Association website.

Jeannette Beranger of The Livestock Conservancy was the main presenter during the webinar, which also included a producer panel featuring heritage sheep breeders Leslie Johnson (American Karakul Sheep), Brian Larson (Lincoln Longwools) and Oogie McGuire (Black Welsh Mountain Sheep).

“Well, as a fiber person and wool producer, I found the choice of breeds that the presenters represented very interesting,” wrote one webinar attendee after the session. “I was especially happy to have Karakuls in the mix and I am looking to obtain some and get a flock going.”

Click Here for more information.

Wool Connect Conference Set for Oct. 6-8

The Schneider Group – an international topmaker and buyer of American wool overseas – is planning a virtual meeting concerning sustainability and would like to see wool producers from all around the world take part on Oct. 6-8.

The three-day event will consist of two-hour sessions each day filled with speakers from retail, the wool supply chain as well as other organizations and service suppliers to the wool industry. The goal of the event is to provide information to wool growers about the interest from brands and retailers in sustainability. Other topics to be covered include the latest market insights, solutions to meet the wool demand of the future and accelerate change through consensus while also providing an opportunity for direct dialogue between wool growers and retail apparel companies.

The Wool Connect Online Grower Conference is part of the Schneider Group’s sustainability strategy ‘Together 2030,’ which sets clear science-based targets to combat climate change. In order to successfully implement the Together 2030 strategy, the Schneider Group has developed activities and projects in two areas: 1. industrial emissions reduction within all Schneider Group industrial plants and offices, and 2. wool supply chain collaboration through the Authentico Integrity Scheme and beyond. The Wool Connect conference invites all wool growers and supply chain partners to exchange knowledge and solutions to work together to fight against climate change and ensure a sustainable future for the wool industry, which is also a healthier, more lucrative business for all.

While the conference will be live during the day in Italy, it will be the middle of the night in the United States, beginning at 2 a.m. eastern time each day. Participants can also view recorded sessions at any time that is convenient after the live presentations have ended. The conference will also offer an art auction and is inviting those who photograph the sheep industry to participate. Please let Heather Pearce at [email protected] know if you are interested in participating, passing along a question or receiving the recording.

Tickets are $25 for wool growers.

Click Here for more information.

Suffolk Producers Needed for USSA Survey

The United Suffolk Sheep Association is undertaking a project to assess the needs of the Suffolk breed. Producers do not need to be a member of USSA to participate in the survey. All those who raise Suffolk sheep are encouraged to participate. It does not matter whether you raise purebred registered sheep, unregistered commercial sheep or club lambs. All types of operations are welcome to provide input that will be used for strategic planning for the breed and improving services offered by USSA. This survey will be available until Oct. 15.

To take the survey online, go to: https://www.surveymonkey.com/r/YDF8WSH. If you would like a paper copy of the survey mailed to you, contact the United Suffolk Sheep Association – 641-684-5291 or [email protected]. Survey participants who include their contact information will be entered into a drawing to win one of two $50 Amazon gift cards that will be given away.

Source: USSA

Australian Market Builds on Last Week’s Gains

The Australian wool market recorded solid price increases for the second consecutive week, with all sectors of the market again recording gains.

The national quantity increased to 29,408 bales. Compared to the previous season, the total number offered is 587 bales higher – a marginal rise of 0.2 percent. The larger offering attracted strong, widespread competition. From the opening hammer, it was immediately apparent that price increases were again in the cards.

By the end of the series, the individual Micron Price Guides across the country rose by 30 to 117 cents. These solid increases helped to push the AWEX Eastern Market Indicator up by 47 cents to 937 Australian cents. This equated to a 5.3 percent rise in the EMI – the largest weekly rise (in percentage terms) since September of last year. Due to a strengthening Australian dollar, when viewed in USD terms, the rise in the EMI was higher – a 43 US cent rise for an increase of 6.7 percent.

In a positive sign for the following week, the Fremantle region selling last, continually strengthened as the sale progressed. So much so, that the Fremantle MPGs for 19.0 to 21.0 micron closed at higher levels than those in Sydney and Melbourne. The skirtings again followed a similar path to the fleece, recording solid increases of generally between 40 and 60 cents.

The crossbreds also made further price improvements, the crossbred MPGs gained between 9 and 55 cents for the series – 28.0 micron and finer recording the highest gains. Solid gains for locks, stains and crutchings pushed the three merino carding indicators up by an average of 30 cents.

The national quantity decreases next week to 25,030 bales. Fremantle again only requires one day of selling (Wednesday). Sydney and Melbourne will be in operation both days. Sydney is designated a superfine sale.

Source: AWEX

Market Has Seen Bigger Drops

Merino prices are currently down a hefty 60 percent on 2019 levels, yet surprisingly the Australian wool market’s significant downturn as a result of COVID-19 isn’t the biggest in the last 100 years.

Research conducted by Independent Commodity Services market analyst Andrew Woods, which was published in Mecardo, found there were four other historic events that resulted in more dramatic wool market declines in the last century than the current one.

In 1921, following the Spanish Flu, prices plummeted by 75pc, and in 1955, a 75pc price correction occurred after the short-lived Korean War wool boom. The infamous reserve price scheme collapse resulted in prices falling by 69pc in 1975 and 73pc in 1991 to 1993.

Woods said these examples meant there was precedent for further price declines in the next couple of quarters if demand does not improve. But he said on a positive note, most of the downturn had already occurred for the cycle, so now the uncertainty revolved around time and how long it would take for prices to start picking up.

Click Here for the full story.

Source: Farm Online National