To View the November 2021 Digital Issue — Click Here

Optimism Abounds on Texas Trailblazers Tour

Susan Shultz, ASI President

I was recently riding in the cab of the pickup with Gary as he pulled a wagon loaded with participants across the beautiful heritage ranch of the Jennings family in Texas.

This was just one of many stops on the Trailblazers Tour sponsored by the National Lamb Feeders Association and American Lamb Board in cooperation with ASI. Gary has served as executive secretary of the American Southdown Breeders Association for more than 30 years and it was a delight to get reacquainted. As he talked, I appreciated his optimism for our sheep industry and his confidence about the future. He told me that there were three P’s that are an ongoing challenge to our industry: predators, parasites and pessimistic people. I hadn’t heard that version of the three P’s before, and it really resonated with me.

Throughout this summer and fall I have attended numerous sheep events, tours and seminars that have illustrated the resilience of producers and their never-ending optimism about the future of our sheep industry. The Iowa Sheep Industry Association sponsored on farm tours at Kevin Goeken’s and Kyle and Carrie Hurley’s places. Both are progressive, commercial operators who have shown their optimism by investing in on-farm infrastructure with their intensive production systems. In Montana and Wyoming, the producers I met at the ram sales had just experienced one of the worst droughts in their history, yet they participated in record-breaking sales as they purchased new genetics for their flocks.

Dr. Reid Redden and Jake Thorne – both with Texas A&M AgriLife and planners of the Trailblazers Tour – showcased the optimism of a diverse set of Texas producers, many of them making plans to expand their operations in order to support the next generation of sheep producers. The epitome of optimism might be Jeff Hasbrouck, who currently serves as NLFA president. He and his wife, Cindy, toured with the group and shared the story of opening the Double J Lamb plant, which is a true family operation. Their belief and faith in the future of our industry was humbling.

Regarding the three P’s quote on the Trailblazers Tour, we saw numerous examples of optimistic producers being proactive and adopting new methods for dealing with predators and using new genetic technology and selection to help with parasites. As far as the third P…, there was not one young producer/leader that I rode on the bus with for three days that was not committed and optimistic about their future in the sheep industry.

Nominations for this years ASI Awards are due Nov. 19. The five awards are the McClure Silver Ram Award, the Camptender Award, the Distinguished Producer Award, the Industry Innovation Award and the Shepherd’s Voice Award. Please nominate those optimistic people that have given back to our industry through the years with their hope, resilience and confidence in our future.

My best.

JULIE STEPANEK SHIFLETT, PH.D.

Juniper Economic Consulting

As the American sheep industry contracts, less market information under Livestock Mandatory Price Reporting has been reported by the U.S. Department of Agriculture’s Agricultural Marketing Service for confidentially concerns of its data providers. In October, the industry saw a welcome reversal of one such retraction.

The National Weekly Comprehensive Lamb Carcass Report, (LM_XL555) has not reported carcass prices since the first quarter of 2017. Carcass prices used to be reported by weight class – the price of a 65- to 75-lb. carcass, for example. Due to ongoing confidentiality guidelines, prices for the individual weight categories still cannot be reported; however, this year, ASI worked with AMS to release a weighted average price for all carcasses across weight classes.

In the first two weeks of October, the total weighted average price for all carcass weights was $548.61 per cwt. According to Erica Sanko, ASI’s director of analytics and production programs, the addition of the total weighted average price to the report will provide market participants with additional information to facilitate price discovery and in making marketing decisions.

Feeder Lamb Prices Remain Strong

Amid tight supplies and strong demand, mainstream feeder and slaughter lamb prices remained high in September. The summer is typically a tight supply period of the year, but this year was particularly tight due to a smaller flock, smaller lamb crop and ethnic demand for lightweight lambs

In September, 60- to 90-lb. feeder lambs at a three-market auction average saw $259.24 per cwt., steady with August and 55 percent higher year-on-year. San Angelo, Texas, saw $270.55 per cwt., Fort Collins, Colo., averaged $247.00 per cwt. and Sioux Falls, S.D., posted $260.18 per cwt.

In the past few years, South Dakota was typically the highest-valued auction market when compared to Colorado and Texas; however, in the last few months, auction prices in San Angelo have come out on top. This unusual swing in price leadership might be due to Double J Lamb reopening the long-shuttered lamb plant in San Angelo.

The Western Video Sheep Video/Internet Auction, Cottonwood, Calif., reported that 75-lb. feeders averaged $286 per cwt. The Billings, Mont., Northern Livestock Video/Internet auction saw 75- to 85-lb. feeders average $259 to $293 per cwt. for October and November delivery in the North Central region. In the North Central United States, Equity Cooperative Sheep and Lamb Video/Internet Auction, Baraboo, Wis., reported 97-lb. feeders selling for $250.25 per cwt.

Slaughter Lamb Prices Peak?

Live, negotiated slaughter lamb prices fell 5 percent in September to $247.43 per cwt, and down 8 percent from the COVID-19 high of $268.34 per cwt. Prices were not reported in April through September 2020 due to confidentiality; however, prices were 46 percent higher than last October at $169 per cwt.

At the New Holland auction in Pennsylvania, Choice 1 to 3 hair sheep were about 3 percent higher in September and up 18 percent year-on-year. For example, 60- to 70-lb. lambs averaged $279.65 per cwt., 70- to 80-lbs. averaged $264.61 per cwt., 80- to 90-lb. saw $266.80 per cwt., 90- to 100-lbs. averaged $263.44 per cwt., and 100- to 150-lbs. averaged $255.23 per cwt.

In 2022, it is expected that the tight lamb supply situation will persist. In theory, if lamb demand exceeds supply, then there is room for lamb prices at retail and foodservice to move higher. It is expected, however, that American lamb demand will be tempered by a substitution of imported lamb for American product.

There are also macroeconomic factors that might mitigate further lamb demand growth.

Potential Macroeconomic Headwinds

Real or perceived reductions in domestic incomes might put a damper on lamb demand in coming months. Previous research by ASI found that income is a significant positive correlation with lamb demand. Further, a recent Survey of Consumers by the University of Michigan reports that inflationary concerns in coming months will be “driven by an income psychology.” This means that if consumers feel that their dollar won’t go as far due to higher-priced goods, then they effectively feel as if their incomes have contracted. The University of Michigan also found that surveyed consumers complained about “lower living standards due to inflation.”

The Survey of Consumers reports that expectations of household incomes for the top third of consumers are expected to fall in the year ahead. Lamb is typically a higher-priced protein – often a luxury item – and many consumers are price sensitive so this macroeconomic phenomenon could adversely affect lamb demand into the new year.

The August Survey of Consumers revealed the, “least favorable economic prospects in more than a decade.” Although consumer economic expectations might improve, due to the “emotional impact,” consumer spending might slow for some time.

Domestic Production Lowers; Imports Up

In January through September, estimated lamb harvest was 1.32 million head, down 1 percent year-on-year. Estimated lamb production January to September was 60.95 million lbs., down 4 percent year-on-year. Freezer inventory is relatively low. Lamb and mutton in cold storage totaled 22 million lbs., up 5 percent monthly and down 44 percent year-on-year.

Lower harvest numbers combined with lower harvest weights yields lower production volume. As lamb demand has expanded, lamb liveweights at harvest have declined. In August and September, liveweights in Federally Inspected harvest averaged 119 lbs., down 5 percent from the same period in 2020 and 12 percent lower than the 2015-2019, five-year average of 135 lbs.

At the beginning of October, 260,933 head of lambs were reported in Colorado feedlots – 30 percent higher than October 2020 and 16 percent higher than October’s five-year average. There are several possible explanations. The industry is further consolidating feedlots in Colorado, numbers are up at Double J Lamb Feeders (with their new processing facility in Texas), volume is building in anticipation of a particularly high-demand December sales, and there is some slowdown in harvest and numbers are building.

Lamb imports totaled 172.8 million lbs. January to August, up 24 percent year-on-year. In this period, Australian imports were up 19 percent to 127.2 million lbs. and New Zealand imports were up 39 percent to 42.9 million lbs.

Mutton imports were down 23 percent to 54.7 million lbs., of which Australian mutton imports were down 29 percent to 47.4 million lbs. and New Zealand mutton imports were up 45 percent to 6.1 million lbs.

In January to August, mutton exports totaled 1.83 million lbs., down 87 percent year-on-year. Lamb exports totaled 255,000 lbs., down 18 percent year-on-year.

There might be multiple reasons for lower lamb and mutton exports, including domestic record-high prices. It is expected that lower lamb and mutton exports reflect the strong lamb and mutton domestic markets. Since the advent of COVID-19, adult sheep slaughter has increased while lamb harvest has declined. Adult sheep harvest was about 6 percent of lamb harvest in April 2020 and climbed to 10 percent in August 2021. As the price of lamb increased, the production of mutton increased to provide a more competitive alternative to consumers, but is also possible that stronger cull ewe prices and drought conditions across the West are prompting greater harvest rates.

Wholesale Market Holds

The cutout value less an industry average processing and packaging cost in September averaged $627.51 per cwt., about steady with August and 72 percent higher year-on-year. The lamb primals ranged from 62 to 76 percent higher year-on-year.

The loin bounced around $500 per cwt. for years prior to COVID-19, then took off exponentially, more than doubling in 18 months. The loin, trimmed 4×4, averaged $1,051.86 per cwt. in September, up 3 percent monthly and 62 percent higher year-on-year.

The 8-rib rack, medium, averaged $1,410.99 per cwt. in September, down 2 percent year-on-year. The shoulder square-cut saw $548.50 per cwt. in September, also down 2 percent monthly. The leg, trotter-off, averaged $603.67 per cwt., down 1 percent monthly.

Ground lamb saw $789.97 per cwt. in September, down 8 percent monthly and 35 percent higher from a year ago.

Retail Prices Higher

Part of the success of lamb demand at retail has been in developing value-added products that make at-home lamb preparation more convenient. In an Oct. 1 podcast for Meat + Poultry, Anders Hemphill, vice president of marketing and brand strategy for Superior Farms, said the company offers a pre-seasoned garlic-rosemary leg steak that has done well under a private label for Wal-Mart. It also sells a pre-seasoned lamb shank that has sold well at Costco in Northern California.

Overall, lamb at retail remains strong although there is some leveling off as foodservice comes back online, Hemphill said. Shoulder blade chops saw a featured-weighted average of $6.99 per lb. in early October, up 24 percent from a year ago. Rib chops saw $14.99 per lb., up 23 percent; the leg (shank/butt) averaged $8.56 per lb., 72 percent year-on-year, and leg cutlets saw $12.99 per lb., up 28 percent.

Wool Market Sluggish

Since the summer of 2021, Australian wool prices have been declining. In October, Australian Wool Innovation Ltd. reported that buyers in the Australian market were operating under “extreme price sensitivity.” Thus, demand might be fragile in the coming months for American fall wool sales and sales of remaining wool in storage.

On Oct. 7, the Australian Easter Market Indicator was Australian 1,339 cents per kg clean, or U.S. $4.42 per lb. clean. In U.S. dollars, the EMI was up 34 percent year-on-year, 55 percent higher than the COVID-19-low of $2.86 per lb. clean, and yet 36 percent lower than the record high enjoyed in 2018 at $6.86 per lb.

Recall that the Australian wool market faced a declining price trend pre-COVID. Although global wool supplies remain tight, a multitude of demand factors dragged prices lower. By some accounts, the wool market remains in an eight- to 10-year cycle and wool prices will rebound in coming years, but the current price outlook is concerning.

One demand factor that might be at play in the international wool market is the increased concentration of raw wool demand and processing in the hand of a single buyer – China. In theory, as market concentration increases, the ability for price influence also increases. What happens in China affects the global wool market. In September, AWI reported that many wool mills in China were without reliable power with more frequent and more severe electricity rationing and thus Chinese production interruptions constrained demand, likely depressing Australian wool prices.

ABC News Australia reported that there is a renewed effort in Australia to develop a domestic scouring plant. Queensland Wool Processors chairman John Abbott said in early October, “If you are subject to the whims and problems of an overseas manufacturer, then you will suffer the consequences.”

Some of the competitive advantages that China once enjoyed – including cheaper labor, cheap electricity and lower environmental standards – are disappearing according to economic consultant Jonathan Pavetto.

While American sheep producers would rather not see imports of foreign lamb meat into the United States, they could benefit from the import of genetics in the form of live sheep, embryos or semen.

This is especially true when it comes to developing new breeds, reviving heritage breeds or when looking to introduce favorable traits into their flocks.

The importation of sheep (live, embryos and semen) is often perceived as a daunting undertaking as there are many protocols involved in the importation process to safeguard domestic agriculture. The U.S. Department of Agriculture’s Animal and Plant Health Inspection Service has implemented these processes to prevent the introduction of a foreign animal disease that could be devastating to the American sheep industry, as well as native wildlife.

USDA/APHIS does not allow import of live sheep, embryos or semen from some countries due to the animal health situation in the country or region of origin.

Before importing live sheep, embryos or semen, producers should review the import process which includes guidelines and regulations, permits and certifications, and associated user fees on the USDA/APHIS website Import: Bring Live Animals Into the United States. It is also recommended that producers check any specific laws or regulations for importing sheep and germplasm into their state on the USDA/APHIS website State Regulations for Importing Animals.

The next step is to apply for a live animal import permit, which can be submitted online through ePermits (this requires a USDA eAuthentication account). Once an application is approved, an import permit will be issued, and producers can proceed according to the outlined import protocols.

Live breeding sheep can be imported from Australia and New Zealand. Only sheep 12 months of age and older – with no evidence of specific diseases such as Brucellosis – can be imported. Imports from both countries require a permit and export health certificate, with specific import protocols required for each country.

The import process includes an isolation period of a minimum of 60 days prior to exportation and a minimum 30-day quarantine upon arrival to the United States with the tuberculosis and brucellosis testing performed at the start of the quarantine period.

There is only one USDA quarantine facility available for live sheep imports – the New York Animal Import Center – and space must be reserved by the importing party. Those importing live breeding sheep are responsible for any costs associated with quarantining live animals at this facility. The lack of quarantine facilities on the West Coast has made it difficult for producers to import live sheep from Australia and New Zealand, as it is a primary access point for trade from those countries.

Breeding sheep from Canada cannot be imported into the United States due to continued Bovine Spongiform Encephalopathy regulations. Imports from Canada are permitted for direct to slaughter sheep and feeder lambs. However, there are currently no approved feedlots for imported Canadian feeder sheep in the United States. There are protocols for producers that move U.S. origin sheep through Canada from one U.S. location to a second U.S. location.

Like with live breeding sheep, importation of embryos is only permitted from Australia and New Zealand. A key requirement is embryos must originate from an approved collection center authorized by the government agency for the respective country of origin.

There are conditions required to import embryos from both countries regarding the donor animals, the collection and testing of embryos, as well as storage and shipment practices.

Sheep semen can be imported from Australia, Canada, the European Union, Iceland and New Zealand. The import protocols differ for the listed countries and for some member states of the European Union. For example, there are specific post-arrival requirements for sheep semen from Canada, the European Union and Iceland that involve record keeping requirements for distribution and first-generation progeny animal identification (see these requirements on the USDA/APHIS website).

Although producers have successfully imported live sheep, many find importing embryos and semen easier due to the logistical challenges associated with live animals. Regardless of the approach taken (live, embryos or semen), producers that decide to import sheep should have a good understanding of the processes involved and contact USDA for assistance.

Given the current pandemic environment, producers should prepare to encounter potential challenges, delays and increased costs associated with the logistics involved in the import process.

For information on importing live sheep, embryos or semen visit the USDA/APHIS website –https://www.APHIS.USDA.gov/aphis/ourfocus/animalhealth/animal-and-animal-product-import-information/imports/live-animal-imports.

CAROL WALLER

CW Communications

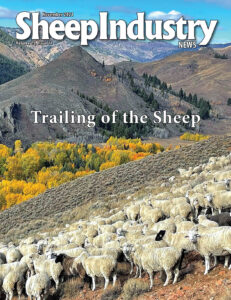

They came from all over the United States and several foreign countries to a small community in Idaho to celebrate the 25th anniversary year of one of the most unique events in the world – the Trailing of the Sheep Festival.

They came to eat and cook lamb, get creative with wool, watch top sheep dogs in action, hear stories of life on the land from sheep ranching icons and families – including ASI Secretary/Treasurer Ben Lehfeldt – and watch a band of 1,500 sheep parade through the center of town. From Oct. 6-10, an estimated crowd of 25,000 came to soak in the celebration in Idaho’s Sun Valley.

“We created this event 25 years ago to educate the new residents of the Sun Valley area on the long history and heritage of sheep ranching here,” said Flat Top Sheep Company rancher John Peavey. He is the Trailing of the Sheep Festival co-founder (along with his wife Diane), and the Festival’s current board chair, as well as a lifelong industry veteran, ASI member, third-generation rancher and a visionary who was inspired to turn a conflict into an opportunity for understanding.

“There were many people moving here who were surprised to see sheep trailing to winter and summer pastures on ‘their bike path’ and were not particularly happy about it,” Peavey explained. “So, we took the opportunity to tell them that the bike path could not have been built without the sheep ranchers allowing their designated traditional right of way to be used for it and we invited them to trail the sheep with us.

“Over the years the festival has grown into a multi-day event showcasing the various aspects of the sheep industry – the culture, the cuisine, the history, the people, the stories and of course, the sheep, and now it is a nationally recognized and beloved community event,” he added.

For its 25th anniversary year, festival organizers created several special programs and projects, many of them in keeping with the storytelling goals that are part of the weekend. This year The Good Shepherd monument – a legacy tribute which includes 11 life-sized bronze sculptures featuring eight sheep, a sheepherder, horse and dog was dedicated in Hailey, Idaho.

“There are memories and histories in the face of the monument’s shepherd and in the words in the pavers surrounding the figures,” Peavey explained.

Festival co-founder and Artist Director Diane Josephy Peavey noted the importance of stories that were shared by author, essayist and former Wyoming sheep rancher Gretel Ehrlich, who was keynote speaker at the Sheep Tales Gathering and through the Peruvian Ballet Folklorica performance of the Utah Hispanic Dance Alliance and Chaskis Peruvian musicians.

A new Trailing of the Sheep Festival Cookbook was created featuring authentic recipes from Idaho ranch families and festival friends, and there was a special 25th anniversary quilt made up of 15 individually created, sheep-related quilt squares raffled off to one lucky winner.

The festival’s Folklife Fair was filled with more than 60 unique vendor booth selling all types of hand-crafted sheep and wool related products and food, including American lamb. There were also live demonstrations of sheep shearing and spinning, sheep wagon displays and performances by cultural groups including the Boise Highlanders, Oinkari Basque dancers and Peruvian dancers and musicians.

The Championship Sheep Dog Trials were expanded to four days this year and had nearly 100 competitors from around the western United States and Canada. Taking home top honors was handler Diana Sylvestre with dog Jemma from Hopland, Calif.

The stories and lives of Idaho ranchers have always been an integral part of the festival programming, and this year was no exception. They included John, Diane, Tom, and Cory Peavey from Flat Top Sheep Company – whose sheep were used in the popular Championship Sheep Dog Trials – John Faulkner and John Etchart of Faulkner Land & Livestock – whose sheep were brought down the mountains and paraded through downtown Ketchum while thousands of spectators lined the streets – and the stories of Cindy Siddoway, Cory Peavey and Dennis Burks, who participated in the Sheep Ranching Q&A session.

This year, the American Lamb Board hosted a group of journalists and bloggers to experience the festival and expose these prominent food influencers to the rich history and heritage of sheep in the area. The group was immersed in festival activities from cooking classes to the lamb dine around, to the sheep dog trials and the famous Big Sheep Parade. Many of the participants have already shared their experiences at the festival on their social media channels.

“Our guests spent the fun-filled weekend celebrating the sheep industry and came away with a new appreciation for how delicious American lamb makes it to their plates,” said ALB Executive Director Megan Wortman.

Start planning now to attend the 26th annual Trailing of the Sheep Festival on Oct. 5-9, 2022.

From wool scouring and testing to lamb processing and hair sheep, the 2021 Trailblazers Tour offered participants a three-day synopsis of the Lone Star State’s diverse and evolving sheep industry, concluding with a tour of the country’s premier wool testing lab.

Hosted by the National Lamb Feeders Association in conjunction with ASI and the American Lamb Board, the tour took young sheep industry professionals from Austin to San Angelo, Texas, the last week in September with the goal of introducing innovative ideas that might spark them to break new ground in their own operations.

Nearly two dozen participants with backgrounds ranging from wool warehouses and lamb processors to sheep production and research took part in the tour. They came from all across the country – from Massachusetts to Washington State (and even Texas) – to get an up-close look at the future of sheep in the state while developing an appreciation for the past, as well.

“Getting to see firsthand the various production styles and multitude of sheep industry infrastructure and leadership we are fortunate to have here in Texas made this tour a resounding success,” said Texas A&M AgriLife’s Jake Thorne, who developed much of the agenda for the tour. “Our Texas sheep industry is incredibly diverse and over the course of the tour we really tried to showcase all those different areas. We are incredibly thankful for the folks who were willing to host this group at their ranches, mills, auctions, processing plants and restaurants, and spend some time sharing about their businesses and involvement in the sheep industry.”

Joining the future leaders of the American sheep industry on the tour were several current leaders in NLFA President Jeff Hasbrouck (and his wife, Cindy) and board member Tasha Wahl, as well as ASI President Susan Shultz of Ohio.

“I just think this was an amazing group of young people who are going to do big things in the sheep industry in the years to come,” said Shultz, who made an effort to visit with each of the young producers during the tour. “I was impressed by each and every one of them in our conversations.

“As an ASI officer, it was also exciting to see the new wool lab (which was supported financially by ASI’s for-profit Sheep Venture Company and the National Sheep Industry Improvement Center in cooperation with Texas A&M) in the final stages of preparation for testing the 2022 American wool clip.”

The tour officially kicked off with dinner on Sunday, Sept. 26, at Austin’s Sour Duck Market. Participants enjoyed lamb meatloaf sandwiches that evening before nutritionist and food marketer Allison Beadle took to the restaurant’s outdoor stage to discuss the explosion of lamb demand during the COVID-19 pandemic.

“Consumers are trying to eat more protein in general, and lamb is a lean protein,” she said.

Beadle works with ALB (which arranged for her appearance on the tour) and told young producers that their family’s story is critical to showing the American public how their food is produced. She encouraged those on hand to use social media to reach out to consumers, but discouraged them from getting into public spats with online trolls.

“You have to know who you are dealing with online, but sometimes there’s no way to know for sure,” she said. “Nine times out of 10 it doesn’t pay to respond at all.”

The next morning the tour headed for the Hamilton Sheep Station of Alan and Jolene McAnelly. The White Dorper operation uses regenerative agriculture – no-till drilling, no pesticides, herbicides, commercial fertilizers or chemicals. Alan McAnelly focuses on raising hardy commercial rams for producers, but his passion for raising sheep is about more than just livestock.

“Raising sheep is one thing, but it’s really about managing forage and pasture,” he told the group.

As a Texas producer, tour participant Michael Farris had visited Hamilton Sheep Station (and other stops on the tour) in the past, but couldn’t pass up the chance to take part in the educational tour.

“I probably learned a little more about their operations this time around,” Farris said. The first time I visited some of these operations, we learned more about estimated breeding values, so this was a little different focus. I definitely got something out of every stop on the tour – even the ones I’d been to before.”

While there’s an abundance of land in Texas, Farris said he’d be interested in future tours that might provide insight into operations that aren’t pasture-based.

“I don’t have an abundance of land to work with,” said the hair sheep producer. “I understand there’s a place for range sheep, but there are also some benefits to confinement situations.”

Eliminating parasites and predation rank high on the list of benefits for Farris, who lives within three to four hours of most the stops on the tour.

“It was a great three days,” he said. “I’m glad I took the time to be there. We were bombarded with a lot of good information, and I just tried to learn as much as I could. You never know when you might pick up that one little thing that will really make a difference in your own operation.”

Hair sheep day on the Trailblazers Tour continued that Monday with stops at the Hamilton Sale Commission, Stegemoller Ranch and Capra Foods.

“I love cattle, but sheep are what’s paying the bills these days,” Derek Poe told the tour before participants enjoyed lunch at his sale barn restaurant. “Every year we say, ‘This is the best year yet,’ and it just keeps getting better.”

Cody Stegemoller took over the family’s cattle operation and soon made the switch to running Dorper sheep.

“If I’m going to work hard, I’d like to make some money,” he told the group of his decision. “We’re all sheep now, no cattle.”

Stegemoller raises his own replacements and his goal is to raise lambs that can “get to 100 pounds efficiently.” In reality, however, he sells most lambs between 75 and 85 pounds.

The final tour stop of the day was Capra Foods, which processes Dorper lambs at its facility in Goldthwaite, Texas.

Day two offered participants a look at the role the show sheep industry plays in Texas – a state that has half a dozen major shows each year in addition to smaller shows at the county level.

The Jennings family’s Cornerstone Flock is known for producing show quality Southdowns.

“We have 40 to 50 ewes who only leave the barn two weeks a year,” said Aaron Jennings who returned to the family ranch in recent years to work with his dad, Gary. “That’s not great livestock management, but that’s what it takes sometimes to win in the show pen. Our sheep have to be able to survive our conditions and win in the show ring at the same time.”

While many think of Southdowns as cute, farm-flock style sheep, Gary Jennings said when they are turned out he’ll often find the Southdowns in some of the ranch’s most remote, rugged country.

“They are very adaptable sheep,” he said.

Stops at Jacoby’s Feed & Restaurant in Melvin, Texas (try the chocolate chip cookies if you ever get there) and the Powell Ranch in Fort McKavett, Texas, followed.

The Powell family has raised Rambouillet sheep since the early 1900s and bloodlines on the ranch today still trace back to that original flock. The ranch runs cattle in addition to 2,500 ewes and would be open to expanding the flock if the opportunity arises, said James Uhl, who works for his grandfather, Jimmy Powell, on the ranch.

“A lot of our neighbors have gotten out of ranching, so we seem to have more predators now,” he said.

When talk turns to predators in Texas, wild hogs come up more often than the traditional coyotes that get mentioned first in so many parts of the country.

“I came home with a new appreciation for coyotes after hearing all of the stories about wild hogs,” said Oregon producer Mary Smallman, who manages the Oregon State University Sheep Research Center. “I wish all of the Texas producers the best, because they have it pretty hard with their climate and predators.”

While many in the state have switched to Dorpers, Uhl said the ranch is committed to fine wool sheep.

“That’s not to say we’ll never get into Dorpers, but we believe the wool will always be in demand,” he said. “That gives us another product to sell. A lot of people are attracted to the Dorpers because they require less labor, but we have the people to make it work with wool sheep.”

David and Stacy Fisher at the HF4 Ranch in Sonora, Texas, still believe in wool sheep, as well. They’ve put considerable time and research into improving their flock in recent years. The couple has developed direct marketing for lamb and is looking to create a value-added product on the wool side, as well. They run cattle and goats, but “fine wool sheep are really the main part of our business.

“I like the business and a I want to stay in the business,” he told tour participants. “I can still make money on wool sheep.”

Fisher has added new genetics to the flock, brought in a new shearing crew and moved into fall lambing as he looks to push the operation into the future.

The second day wrapped with a visit to the Buchholz Ranch, run by former ASI Executive Board member Bob Buchholz and his family. Running sheep and goats on a number of far-flung properties wouldn’t be possible for the family without guard dogs.

“Predators were running a lot of people out of business in some of these areas,” he said. “But I can operate a lot of country with guard dogs. We made it work and guard dogs did it for us.”

The final day of the tour was spent in San Angelo, where participants got a look at the abandoned lamb plant reopened by Double J Lamb in 2020, the scouring line and wool warehouse at Bollman Industries, Producers Livestock Auction, Dr. Tim Turner’s Southwestern Livestock Mineral facility and the Texas A&M AgriLife Research Station. The station is home to the soon to be up and running commercial testing lab for American wool.

ASI Vice President Brad Boner of Wyoming testified on behalf of the sheep industry before the U.S. House Agriculture Committee at its Hearing to Review the State of the Livestock Industry on Oct. 7 in Washington, D.C.

In addition to his opening statement and taking questions from members of the committee, Boner offered a more in-depth written testimony to the committee.

His written testimony appears below.

Chairman Scott, Ranking Member Thompson, and members of the committee, thank you for the opportunity to speak with you today. I am Brad Boner, a sheep producer from Wyoming and the current Vice President of the American Sheep Industry Association. ASI is the national trade association for the United States sheep industry, representing the nation’s 100,000 lamb and wool producers.

America’s sheep producers continue a strong tradition of supporting wildlife habitat, natural resources and open space across the country – all enabled by careful resource management while grazing our flocks on private and federal lands.

The sheep industry is very broad and diverse, nationally accounting for an economic impact in excess of $2.7 billion to the United States economy. I appreciate the opportunity to present our industry’s perspective across a number of priorities.

Mandatory Price Reporting

Ensuring there is not a lapse in Livestock Mandatory Price Reporting is critical to the United States sheep industry. Unfortunately for sheep producers, LMR has not adjusted to changes in the lamb industry. Of particular concern is the implementation of the current confidentiality guideline of the United States Department of Agriculture which restricts the information available to sheep producers.

In 2011, there were 13 reports under mandatory price reporting for lamb. Today, there are only five reports available, all of which are national reports released on a weekly basis. Of these five reports, the amount of information provided in the slaughter lamb report has been diminished over the years with the data on formula traded lambs not being reported in over a year.

These lapses in price reporting led the industry last month to support USDA’s withdrawal of Livestock Risk Protection – Lamb since the sporadic availability of the product unpinned by the lack of reported prices rendered the program of limited use. LRP-Lamb was a federal lamb price insurance product and the only risk protection product available to lamb producers and feeders to hedge their risk. Robust and transparent, third-party price reporting is paramount to producers’ ability to secure necessary loans in order to finance operations, expansions and startups.

Without robust and transparent price reporting, lenders will find it difficult – if not impossible – to assess the viability of loan requests presented to them. This may lead to loans being denied that otherwise would have been accepted if trustworthy price reporting were available. Increased consolidation in the packing industry across livestock will only continue to hinder producers’ access to accurate price reports and issues of confidentiality will need to be resolved sooner rather than later to preserve the value of LMR for sheep producers and the other commodities that rely on these reports.

The American Sheep Industry Association has proposed a number of potential changes to LMR that we believe would enhance the program’s effectiveness for lamb producers while protecting the interests of everyone in the supply chain.

The first recommendation is to change or replace the 3/70/20 Confidentiality Guideline. This guideline is not required by statute and current market prices have a relatively short-term relevance. By the time prices are reported, they only reflect past transactions. Prices and market activity can be reported without sacrificing confidentiality and the current confidentiality guideline by USDA is stifling the information lamb producers need to make accurate marketing decisions.

Additionally, ASI has recommended that USDA amend LMR, so it reflects the unique nature of the lamb industry, such as including a definition for Vertical Business Relationships that includes custom processors and lowering the packer processing threshold again for reporting to 20,000 head to reflect current slaughter lamb numbers. ASI believes these changes would greatly enhance the program for all users.

Packer Capacity and Concentration

The lamb processing sector is highly concentrated with two to three firms influencing the majority of market sales and imported lamb influencing the other 50 percent of lamb meat sales in the United States. This concentration was highlighted during the outset of the COVID-19 pandemic, when the sudden loss of restaurant and foodservice sales forced the bankruptcy proceedings of our second largest lamb packing facility – Mountain States Rosen – owned by the Mountain States Lamb Cooperative.

The loss of this lamb packer at the height of what is traditionally the lamb industry’s busiest marketing season – the Easter/Passover holiday – exposed serious deficiencies in the industry’s supply chain, namely the lack of adequate packing and fabrication capacity in the event of a market disruption.

The American sheep industry appreciates the current efforts by Congress and the administration to look at investments and opportunities for meat and poultry processing infrastructure, and building resilient supply chains. The sheep industry continues to experience gaps in sufficient processing capacity across the country, particularly in the upper Midwest and Eastern regions of the nation, where lamb producers have shown growth in flock size and demand for lamb has expanded for local and non-traditional consumer markets.

Sheep producers in these regions frequently comment that they are only offered one date – usually a year in advance – to get their lambs processed. If they miss that date or find themselves short or long of their anticipated head count, they have few – if any – viable alternatives available. Relatively modest investments – especially through grants or federally backed loans – to increase processing in areas of the nation where we have both supply and consumer demand could have a huge impact on the future of this industry.

This is not only an issue of packing capacity in these regions, but also the hurdle of interstate shipment due to the lack of federally inspected facilities.

Additionally, as in all of agriculture, access to skilled labor remains a tremendous challenge for our packing infrastructure. ASI supports efforts to look at additional flexibilities that allow small and regional processing facilities to engage in interstate commerce, without negatively impacting our vital food safety system.

Trade

The lamb market in the United States is heavily influenced by imported lamb – particularly from Australia and New Zealand – which make up over 50 percent of total lamb sales. The American Sheep Industry Association in response has asked successive administrations to prioritize lamb export opportunities for United States producers before allowing additional imports.

Our industry still cannot access potentially lucrative markets like China, the European Union and the United Kingdom. This despite an announcement last month that the United States would begin allowing imported lamb from the United Kingdom. The domestic industry’s ability to withstand additional import pressure at this challenging time, and the United Kingdom’s tremendous potential for significant lamb exports in the wake of their departure from the European Union are a looming concern for United States lamb producers. A cautious and deliberative approach is necessary to ensure that while trade may be free, it is fair.

Wool trade too remains a challenge. While we have seen an increase in wool shipments to China, numbers are still significantly lower than they were prior to the tariff retaliation. Additionally, shipping challenges continue to mount. The same holds true for the export of pelts. Prior to the implementation of tariffs, 72 percent of U.S. raw wool exports and 80 percent of U.S. sheepskins were sent to China.

Continuing to build strength in the international marketing of lamb and wool requires a commitment to the promotion and export of United States wool to export markets through strong USDA Foreign Agricultural Service program funding. ASI is the cooperator with FAS for American wool and sheepskins and finds success every year in securing customers through the Market Access Program, the Foreign Market Development Program and the Quality Samples Program. In 2001, ASI relaunched an export program for wool and significantly improved the competitiveness for American wool.

Barriers to Expansion

There is tremendous reason for optimism in the American sheep industry. Lamb demand domestically is on the rise, wool is being recognized as a natural regenerative fiber for performance wear, and the vast environmental benefits of targeted grazing are being recognized by our private and public land managers across the country.

With that optimism, there are barriers to our industry reaching its full potential.

State Wage Regulations

The sheep industry has relied on sheepherders to care for, protect and tend to their flocks since time immemorial. For large and mid-sized Western range operators, these sheepherders are an integral and necessary part of their operation, especially those that graze public lands. This work necessarily requires living in a camp with the sheep seasonally and moving the flock nearly daily to achieve range management goals in the most rugged and isolated lands in the United States.

However, state wage and overtime regulations – particularly in California and Colorado – threaten to devastate our industry, mandating wages for this work that are untenable. If a solution is not found to bring these wages into line, there will not be a commercial sheep industry in these states, which represent our second and third largest sheep inventories and the sites of our largest lamb processing facilities.

H-2A Temporary Agricultural Workers

The American sheep industry has a decades long history of a reliable, consistent and legal workforce. Sheep ranchers depend on the H-2A sheepherder program to help care for more than one-third of the ewes and lambs in the United States. To meet those needs, the industry has participated in temporary visa programs (in various forms) since the 1950s. As a result, sheep producers employ a legal labor force with an estimated eight American jobs created/supported by each foreign worker employed. A workable temporary foreign labor program is essential for the sheep industry, including the special procedures for herding in future legislation involving immigration workers.

Access to Animal Drugs

With approximately 5.2 million head of sheep, animal drug industries often find that securing Federal Drug Administration approval for new, innovative and even older products is not cost effective for this market. The lack of access to these key technologies used by our competitors in other countries, places United States sheep producers at a disadvantage, not to mention limiting their ability to protect and prevent disease to ensure the welfare of their animals. While imported lamb may be treated with a product that has a USDA/Food Safety Inspection Service accepted residue level, that same product often is not approved for use in the United States by the FDA.

Predation

Coyotes, mountain lions, wolves and bears kill tens of thousands of lambs each year. Livestock losses attributed to these predators cost producers more than $232 million annually. American sheep producers rely on USDA/Wildlife Services, state and county programs to effectively control and manage predation by state managed and federally protected predatory species.

The livestock protection program is majority funded by industry and local cooperators. Sheep producers have adopted many techniques to reduce predation, including the wide-spread use of livestock protection dogs, but access to lethal and non-lethal predator control methods must be maintained.

Conclusion

The American sheep industry has faced challenges these past years, related and unrelated to the COVID-19 pandemic. Like all industries, the pandemic highlighted flaws and created failures in our supply chains, but we have emerged as a stronger industry. We did lose our second largest packing facility, but also saw two new packing facilities come on-line, both either entirely or majority producer-owned, showing the optimism in our industry.

I’ll reiterate the growth in demand for lamb and fine wool, and the environmental benefits of sheep production for range health, control of invasive weeds and reduction of hazardous fuel loads. With minor policy adjustments, the American sheep industry is poised for exponential growth.

Thank you for your support of the livestock industry and for allowing me to visit with you about our priorities.

Farm Flock Economics Webinar Available

The most recent ASI-sponsored webinar – Farm Flock Economics – is now available on demand on the ASI website at SheepUSA.org/growourflock-resources-educationalwebinars.

In the webinar, Bridger Feuz of the University of Wyoming offers a look at a variety of economic strategies and worksheets that will assist sheep producers in managing the business side of their operations.

“There’s no shortcut or workaround for record keeping,” Feuz said during the webinar. “You just have to buckle down and do it.”

While Feuz admitted that particular chore is often the least-favorite part of the business for many producers, he stressed that it is as important as every other aspect of the business. Unfortunately, while producers often enjoy studying genetics, investigating new feed sources or improving wool quality, taking a closer look at the economics of their operations is often not a favored task.

Through the University of Wyoming Extension, Feuz has developed the Wyoming Ranch Tools website. Producers will find a number of worksheets, fact sheets and resources designed to help them get a better handle on the financial side of their operations.

To learn more, visit UWyoExtension.org/ranchtools.

Nov. 19 is Deadline to Nominate for ASI Awards

It’s time to submit nominations for ASI Awards, which will be presented during the 2022 ASI Annual Convention in San Diego, Calif. The deadline for nominations is Nov. 19.

There are five awards open for nominations: the McClure Silver Ram Award, the Camptender Award, the Distinguished Producer Award, the Industry Innovation Award and the Shepherd’s Voice Award.

The McClure Silver Ram Award is dedicated to volunteer commitment and service and is presented to a sheep producer who has made substantial contributions to the sheep industry and its organizations. The Camptender Award recognizes industry contributions from a professional in a position or field related to sheep production. Nominees should show a strong commitment and a significant contribution to the sheep industry. The Distinguished Producer is a way to recognize an individual who has had a significant long-term impact on the industry.

The Industry Innovation Award recognizes the accomplishments of an individual or organization that improves the American sheep industry in a game-changing way. The Shepherd’s Voice award goes to outstanding media coverage of the industry.

Nominations must be submitted to ASI by Nov. 19, and past recipients of these awards are not eligible. To receive an application, call 303-771-3500 or email [email protected]. The one-page nomination form can also be downloaded from the website at SheepUSA.org/researcheducation-awards.

JOE ESNOZ, 1931-2021

Joe S. Esnoz was born on June 20, 1931, in Fresno, Calif., to Jose and Manuela Esnoz.

He was the youngest of three children. His family moved to Lost Hills, Calif., when he was 3 years old. It was there that the family continued to work the sheep business for many years to come. Joe attended Lost Hills School and then Wasco High.

He was drafted into the U.S. Army in 1951 and fought for his country until he was honorably discharged in 1954 with a Purple Heart. After coming home from Korea, he purchased his father’s sheep. The Esnoz sheep business continued on.

On Aug. 2, 1958, Joe married the love of his life, Sharron McDaniel. They had a long and loving marriage of 61 years while raising their two boys, Phillip and Michael, who were their pride and joy. Along with running his sheep business, Joe served on many boards during his life, including: Lost Hills Union School, Wasco Union High School, Semi-Tropic Gin, Western Range and the California Wool Growers Association.

He joined Western Range in 1964 and served on the board for approximately 25 years. He was president of Western Range from 1986 to 1989. He was also an Honorary member of the Kern County Basque Club. With ASI, Joe served as chair of the American Lamb Council.

Joe was an extremely hard-working man, who loved his family and his sheep. He never missed an opportunity to teach those around him, nor did he pass an opportunity to learn something new. His work ethic was like that of no other, and he instilled in his children and grandchildren the values that he carried so deeply with him. His relentless quest for success in all aspects of his life was immeasurable.

He was preceded in death by his wife Sharon and sister Florence. Joe is survived by his son Phillip Esnoz (Denise), son Michael, grandchildren Nicole Giannelli (Nick), Kristara Esnoz, Joseph Esnoz (Cassie), Emily Finch (Jordan), and Elizabeth Esnoz. Great grandchildren Elise Giannelli and Gracian Esnoz. Sister; Juanita Eyherabide and numerous nieces and nephews.