In May, the United States was challenging trade policies on two fronts – China and Mexico.

The lamb and wool industries are increasingly integrated into the global economy with more than 50 percent of our available lamb from Australia and New Zealand, our largest raw wool export market in China and our largest live and lamb export market in Mexico. Tariffs can add costs to trade, or can be prohibitively high as to halt trade altogether – as threatened with American lambskins to China. Regardless of the level of tariff enacted, tariffs – or even the threat of tariffs – disrupts business as usual, adding costs and narrowing margins.

Sheep producers are impacted by tariffs, but so too are rural economies across the United States. A sheep industry impact analysis revealed that one dollar in sheep and sheep-related production added an additional $2.87 to the American economy in 2016. That is, one dollar of sheep production and related goods has a multiplier effect of nearly three times the initial sheep investment.

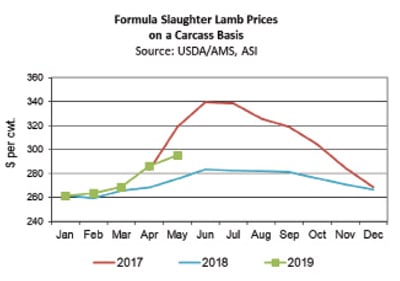

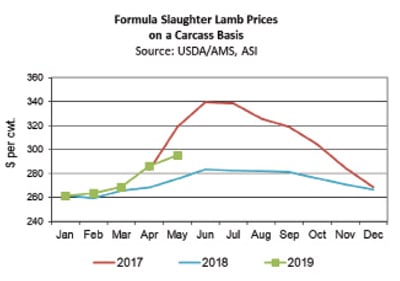

Slaughter Lamb Markets Strong

Formula slaughter lamb price averaged $295.57 per cwt. on a carcass basis in May, up 3 percent monthly and 7 percent higher year-on-year. The live-equivalent average was $145.85 per cwt. Live, harvest weights for formula lambs were 167 lbs., up marginally in May and 5 percent lower year-on-year.

Live, negotiated slaughter lambs averaged $153.40 per cwt. in May, up 1 percent monthly and down 6 percent year-on-year. In the year through May, reported lambs sold on a live negotiated basis was down 31 percent to 46,890 head. It is hypothesized that more lambs are channeled through formula-based marketing agreements and more lambs are packer-owned.

In May, feeder lamb prices at auction in Colorado, Texas, and South Dakota averaged $178.75 per cwt., down 2 percent monthly and down 9 percent year-on-year according to the Livestock Marketing Information Center (6/7/19).

Meat Prices Higher

The wholesale composite averaged $389.48 per cwt. in May, up 2 percent monthly and up 3 percent year-on-year. All primals gained monthly with the leg seeing with the largest lift.

The 8-rib rack, medium, averaged $890.85 per cwt., up 0.2 percent monthly in May. The shoulder square-cut gained 3 percent to $293.41 per cwt. The loin, trimmed 4×4, saw $522.80 per cwt., up 0.5 percent monthly. The leg, trotter-off, averaged $381.34 per cwt., up 5 percent monthly.

Compared to a year ago, the rack was 5 percent higher in May, the shoulder was 4 percent higher, the loin was 5 percent lower and the leg was up 3 percent.

Production and Trade Increase

In the year through May, an estimated 821,995 head of lambs were harvested, up 3 percent year-on-year. Lamb production was estimated at 56.7 million lbs., down 1 percent year-on-year.

Production was lower because average carcass weights through May averaged 69 lbs., down 4 percent. Federally-inspected live weights at harvest were at a five-year low for the first five months of the year.

Lamb Market Analysis

American lamb supplies have been tight this year, which has supported higher slaughter lamb prices. As of June 1, 86,652 head were reported in Colorado feedlots, down 12 percent monthly and 36 percent lower than a year ago.

What is puzzling is the while lamb supplies have been tight and prices higher, the percent of overfat lambs – as seen in a higher percentage of lambs grading yield grade 4s and 5s – is high. The percent of lambs with increased back fat was at a five-year high for the first trimester at 31 percent of total graded.

Stronger domestic slaughter lamb prices were also a surprise given imports were up, as were freezer inventories. In the first quarter, imports were up 24 percent year-on-year to 66.4 million lbs. Australian imports were up 22 percent to 49.6 million lbs. and New Zealand lamb was up 28 percent to 16.4 million lbs.

Given limited supply and ongoing dry conditions, Australian lamb prices are at a record high; however, the lower Australian dollar relative to the stronger U.S. dollar gives Australian lamb an export advantage.

It is hypothesized that imported and domestic markets might be seeing some separation. They do not necessarily function as one, integrated market. It is believed that domestic production is channeled more and more into the food service market, while imported lamb fulfills retail accounts.

In the first quarter, estimated lamb availability – not counting freezer inventory or exports – was up 12 percent year-on-year to 102.6 millioin lbs., with imports accounting for 64 percent of the total.

Lamb and mutton in cold storage totaled 41 million lbs. in May, up 32 percent monthly and 20-percent higher year-on-year. May’s total is 87 percent of the highest freezer inventory on record – 47 million lbs. in 2016.

It is often believed that freezer inventory is primarily imported production, but if this is the case, it is difficult to explain some market dynamics. In 2017, slaughter lamb prices rose sharply after a concurrent drop in cold storage stocks by 57 percent in 12 months.

In early June, LMIC forecasted slaughter lamb price on a carcass basis was $294 to $300 per cwt. for the third quarter, up 5 percent year-on-year. Sixty- to 90-lb. feeder lamb prices at auction were forecasted at $167 to $177 per cwt. in the third quarter, up 19 percent year-on-year.

Tight lamb supplies will catch up with the industry in an already low-supply third quarter, pushing prices up.

Lamb Exports Higher

The U.S. Meat Export Federation reported in May that demand for American lamb is still climbing overseas. In the first quarter, lamb exports totaled $6.9 million, up 29 percent year-on-year.

Exports totaled 4,173 MT (9.2 million lbs.), 68 percent higher from a year ago. In January to March, variety meat exports to Mexico were up 81 percent year-on-year to 3,391 MT and 51 percent higher in value to $2.65 million.

Other important lamb export markets include the Caribbean, Canada, the Middle East, Central America and Southeast Asia.

Pelts Continue to Struggle

Pelt prices have been hit hard by sharply higher export tariffs on pelts; however, this is only one part of the story. Tariffs exacerbated an already struggling industry. Like many trends, fashions come and go, and pelts have suffered with new product developments.

For example, the development of synthetic leather – used as an artificial backing to products – has hurt the industry. Some products such as shoe linings in boots have replaced genuine lambskin with cheaper synthetics.

Other headwinds challenge pelt sales. Pelts are sharply lower in competing countries such as Australia and England. Further, Chinese growth is slowing and global growth has been struggling. Additionally, the U.S. dollar remains strong, which means American pelts are at a competitive disadvantage on the world market. A strong dollar means that American goods are more expensive in foreign markets.

The United States exports about 80 percent of its pelts to China. Last August, the duty on American pelts to China was about 8 percent, rose to 18 percent last fall and rose again to 43 percent in June. The industry is looking for alternative markets, but when China became the dominate tanner with cheaper labor and relaxed environmental regulations, other processors closed shop.

Increasingly, American producers are receiving negative credits for pelts. But again, that’s not the whole story. Starting in January, price offerings for pelts have fallen due to the duties, but it is also a time of year when pelts are generally lower quality. Unshorn premium pelts ranged from -$1.50 to $3.63 per piece in May, down roughly 23 percent monthly and down 82 percent year-on-year.

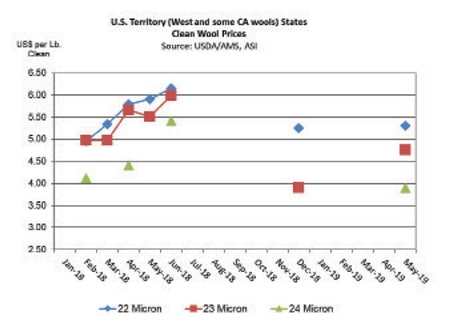

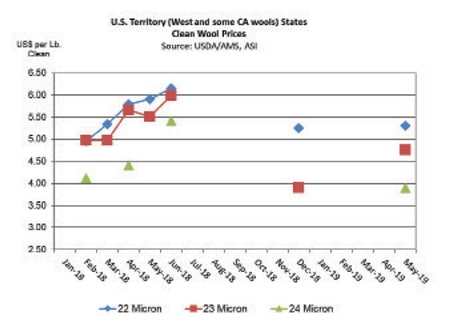

American Wool Prices Lower

On average, American Territory wool prices in May were down 17 percent compared to last year. While the better prepared wools received top dollar, on average, prices were lower on the back of a 25-percent export tariff on raw wool exports to China – American wool’s leading export market.

In May, 18 micron averaged $6.54 per lb. clean, down 7 percent year-on-year. Twenty micron averaged $5.75 per lb., down 12 percent; 22 micron saw $5.03 per lb., down 14 percent; 24 micron averaged $3.90 per lb., down 28 percent; and 26 micron averaged $3.08, down 26 percent. The finer wools lost about 44 cents per lb. clean year-on-year while the coarser wools averaged $1.18 per lb. lower.

Fiber diameter (micron) of wool can explain 70 to 80 percent of wool’s greasy price, according to Australian Wool Innovation Ltd.

This spring, the premium received for fine wool above medium-grade wools was about $1.44 per lb. clean (0.75 cents greasy).

On June 6, the Australian Eastern Market Indicator averaged Australian 1,864 cents per kg clean, down 7 percent year-on-year. In U.S. dollars, the EMI averaged 1,299 cents per kg clean ($5.89 per lb. clean). By June 6, the EMI had weakened in four out of the previous five weeks.

In early June, the Australian dollar continued to weaken, giving Australian wool an export boost. On June 6, the Australian dollar equaled 69.71 U.S. dollars, down 9 percent year-on-year.

One factor affecting American and Australian wool prices is market volatility during the past three months or so, and moving forward. Exchange rate volatility causes price volatility as does uncertainty in available Australian supplies and international trade policies.

Tight global supplies and strong demand continue to support wool prices. In late May at Australian wool auctions, “The increase in confidence, resulted in an aggressive approach, as buyers fought hard to secure meaningful quantity of a relatively small selection,” (Weekly Wool Market Report, 5/23/19).

Within the worsted fabric manufacturing sector, sales are down compared to last year (Queensland Country Life, 6/3/19). Wool fashions calling for fine, worsted wool for suits or uniforms are being challenged by costs. Some processors will produce polyester-blended suits, or lighter-fabric suits (using less wool), while others will look for cost efficiencies in production.

The fundamentals for strong wool prices are present, so hopefully tariff concerns are only a short-term setback.

According to Bruce McLeish, Elders Northern Zone Wool Manager, strong demand from Chinese production of new wool uniforms, or “newly created demand for alternative products,” or short supply means that the “price of greasy wool is unlikely to go down very much in the short term,” (Queensland Country Life, 6/3/19).

W

W