- November 2011

- 2011-2012 Shearing Schools

- Calling Young Sheep Entrepreneurs

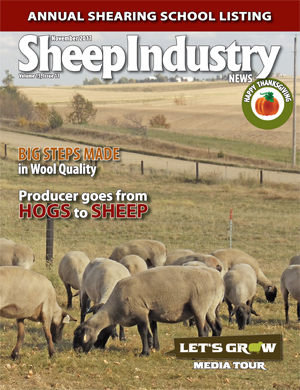

- Hog Producer Turned Sheepman in Georgia

- Let’s Grow Media Tour Kicks off in Iowa and Minnesota

- Nov. 18 Deadline for ASI Awards

- Pelt Market Dependent on a Variety of Factors

- State Producers Valuable to University Programs

- U.S. Wool Producers Make Big Steps in Quality Improvement

(November 1, 2011) As the pelt market continues to bring in higher prices than in previous years, many producers are becoming more aware of the profit potential that pelts have to their operation.

However, it’s also a very complicated market with many variables that leave producers often confused as to what dictates price and what price their pelts should be bringing.

“There are many attributes in a raw lambskin that dictate what finished products can or cannot be made from any particular skin or pelt. Ultimately, demand for those finished products trickles up through the supply chain, eventually shaping the pelt market, and ultimately, pelt credits,” says Mike Wheeler, owner of Nugget International, manufacturer of fine products made from sheep and lambskins.

Currently, the United States reports lambskin prices based on one variable, wool length. However, Wheeler says that there are many other variables that can affect the price of a pelt beside just wool length.

“Today, we have so many different lambs going across the country and volume is smaller. Length alone is a far cry from establishing value of the product,” Wheeler says. “The only positive, definitive and always true thing is that fashion and demand changes, and what is needed (in the way of pelts) today to meet that demand may not be what is needed tomorrow.”

There are factors that affect the wool quality of a pelt and factors that affect the leather (or skin) quality of the pelt. The combination of these factors and the demand for given finished articles are what shape pelt values.

Wool factors include length, color (white, yellow, gray and/or black fibers), wool grade or micron (fineness or the thickness or width of the individual fiber), feel or touch, density (number of fibers per square inch), strength, and so on. There is a wide variation of products, and thus uses, for pelts tanned with the wool left on the skin.

Leather (for both the wool left on the pelt and wool removed from the pelt) factors include seed penetration, seed scar, injection marks, cysts, flay, takeoff, grain, thickness of pelt, shear scars, etc. A main issue for U.S. pelts that the producer can have some control over is cockle caused by ticks.

Size is usually very important, but, depending on the market or the finished products in demand, bigger is not always necessarily better. For example, American skins are good for footwear because of the size, thickness and general firmness of the leather. Fortunately for us, footwear made from lambskin continues to be in demand. If demand shifts away from footwear to lightweight ladies jackets, for example, U.S. pelts will be trading at discounts with values being substantially lower than today’s credits.

“There is an exception to every rule. The market changes year to year. Whatever final products are the focus is going to dictate what is “discounted,” or where the “premiums” might be. Those products will determine where the value is perceived.

Because volume is smaller and not as consistent as in the past, that variation in each category of pelt can be great.

According to Wheeler, he might buy a load of #1 pelts, which have wool length of 5/8ths to 1 inch, and while they all are consistent on that variable, all others could be totally different, making each pelt worth something different than what the price might report.

“Some may have black wool, some may have seed in the leather, some may have superfine wool and some may be really yellow. I can buy #1s for $10, for example, but some of them are worth $1 and some of them are worth $20, so I am aiming to pay mid-range for that product,” he says. “Anything less (than mid-range) is a discount and anything more is a premium, but today’s discounts could very well be next year’s premiums.”

Many other countries, such as Australia, report pelt prices based on several variables. Australia breaks down its reports based on weight of animal, classification of animal (lamb, Merino, crossbred), amount of vegetable matter and wool length.

“Many want that simple matrix (one variable) to figure prices, but it’s more complex and complicated than that,” says Wheeler.

Current Trends in the Market and Quality

Currently, Wheeler says the market demand is in the sheepskin footwear market, and it continues to drive the price.

For producers, he says he sees a few things that can be controlled on the farm in terms of quality that could affect the return for a producer.

First, Wheeler says he is seeing a lot of stained wool – yellow colored, discolored, fecal stained, etc.

“If you have a great market for something that is white, that yellow or stained wool affects our ability to get the most money. You are just eliminated from that market and those premiums,” he adds.

In addition, he says he is also seeing an unusual amount of gray and black fiber. He says often a producer may not even realize it’s there, as often the pelt looks perfect but a pen-sized colored spot is present, and it will kill the skin for a lot of products.

“The further you process the skin you just start seeing all those type of defects. It can be a beautiful premium looking skin, but right in the middle is a black spot. If those products that could have been made with that skin were in high demand, you are out of luck.”