By Julie Stepanek Shiflett, Ph.D.

Juniper Economic Consulting

“Beat of a Different Drum,” Linda Ronstadt’s hit single in the late 1960s is a reminder that lamb hasn’t been trading up like its red meat substitutes beef and pork. Beef and pork have seen tandem price gains in the past year – strengthening by 12 to 13 percent – while lamb posted only a 3 percent gain. The lamb market is following the beat of different drum with the typical positive price support from higher-priced proteins trumped by increased lamb supplies and heightened import competition.

Increased Supply

The lackluster lamb retail market is a concern, given strengthening in the beef and pork sectors. Beef supplies and pork supplies are tighter than a year ago which has supported record-high prices. The cattle herd is the lowest since World War II and pork supplies have been impacted by PED – Porcine epidemic diarrhea. It is expected that PED will further reduce hog numbers but thus far heavier weights have compensated somewhat for reduced slaughter numbers.

The Livestock Market Information Center (LMIC) reported in late May: Additional price support (at retail) has come from higher prices of meat from steers and heifers, and those of pork and poultry. In recent weeks, wholesale cull cow-beef values have averaged about 22 percent above a year ago, tight supplies of cattle have caused packers to bid aggressively pulling live cull cow prices in most markets up 30 percent from 2013. Year-over-year those percentage gains should persist for the balance of 2014, however the normal seasonal price drop is expected into the fall months, (LMIC, 5/30/14).

The Livestock Market Information Center (LMIC) reported in late May: Additional price support (at retail) has come from higher prices of meat from steers and heifers, and those of pork and poultry. In recent weeks, wholesale cull cow-beef values have averaged about 22 percent above a year ago, tight supplies of cattle have caused packers to bid aggressively pulling live cull cow prices in most markets up 30 percent from 2013. Year-over-year those percentage gains should persist for the balance of 2014, however the normal seasonal price drop is expected into the fall months, (LMIC, 5/30/14).

The supply situation is different for the lamb industry. While other proteins are showing reduce cold storage inventory and reduced slaughter, lamb is up on both counts.

The lamb flock is lowest on record, but domestic slaughter was up an estimated 3 percent year-on-year through May and production was steady. How can inventory decline year after year and yet production be maintained? Perhaps the national statistical inventory data underestimates our national flock. Perhaps lambs that were once slaughtered on farms or in non-federally inspected slaughter facilities are now coming under the commercial radar.

Including the import picture helps explain a relatively stagnant lamb retail market. In the five months through May, lamb imports from Australia were up 14 percent. The volume of fresh product fell 1 percent and the percent of frozen product saw a 26 percent gain.

In the first quarter, combined domestic and imported lamb supplies saw a 2 percent decrease year-on-year. However, if freezer inventories are included, the net lamb availability is estimated at 5percent higher.

At the beginning of June, lamb and mutton in cold storage was 41 percent higher than a year ago at 30.3 million lbs. – the second highest recorded inventory after April. To put this into perspective, this volume is equivalent to nearly three months of production. Much of this cold storage is imports, but we don’t know how much.

Lower-Priced Imports?

If imported lamb at retail and foodservice are typically lower-priced than domestic product then this can weaken U.S. lamb demand and weaken domestic prices. Consumers might choose the lower-priced import if the value is considered comparable. This means that there are fewer people left to buy U.S. lamb and prices can fall.

Unfortunately, lack of good data prohibits a better understanding of the degree of substitutes between imported and domestic lamb. For starters, many of the cuts are not defined similarly, challenging an “apples to apples” comparison for prices we do have at wholesale. Second, we don’t have prices at foodservice for domestic or imported product – a sector that reportedly accounts for about 60 percent of the lamb industry’s value.

In May the weighted-average price of imported cuts at wholesale was $684.86 per cwt., down 2 percent year-on-year. The volume and type of cuts might not necessarily be the same year-to-year, but gives an indication of average import price levels.

Competition Counts

American lamb competes against imports and substitute proteins on restaurant tables and in the grocery meat case. Adding value to lamb through the growth sectors of branded and value-added products is one way to develop consumer loyalty and increase margins.

Tyson reported its value-added sales growth was over 6 percent in 2013 compared to 4.7 percent for total sales, (meatingplace, 5/2014). Furthermore, Tyson expects its value-added items to continue to grow, twice the rate of its commodity sales (meatingplace, 5/2014). Currently, 60 percent of Tyson’s pork is value-added and 1 percent to 2 percent for beef and pork.

In June Pilgrim’s Pride and Tyson Foods entered a bidding war for Hillshire Brands –maker of Jimmy Dean Sausages and Ball Park Franks. Tom Gara at the Wall Street Journal.com reported that “there’s a reason Hillshire is such a prize: pre-packaged, branded meats are proving to be a more profitable way to sell meat,” (The Week, 6/13/14).

In the coming year, consumers will be eating more meat at and away from home. The ability of lamb to grab hold a share of that meat expenditure The Power of Meat study funded by American Meat Institute and the Food Marketing Institute found that while still below the pre-recession average, home-cooked dinners featuring a portion of meat or poultry recovered from 3.6 to 3.8 in a typical week (2014). Additionally, among those who changed their meat purchase in 2013, 36 percent increased their spending, up from 9 percent last year.

The Power of Meat study also found that heat-and-eat and ready-to-eat items are being consumed at higher frequencies and more shoppers are buying them. This desire for convenience is also reflected in the types of meals people cook more. One-pot meals increased a 22 percent compared with five years ago. Accelerated growth is also seen for pastas and casseroles and international/ethnic dishes, (The Power of Meat, American Meat Institute/Food Marketing Institute, 2014). Lamb has the unique opportunity to expand its value-added products.

Forecasts

In late April, the LMIC forecasted that domestic production could increase 3 percent in the second quarter and imports could fall 2 percent quarterly. The result is an expected 11 percent quarterly gain in total lamb availability (including the large volume of freezer inventory that carries into the second quarter). Exports and remaining ending stocks in the freezers will reduce this volume to some extent but still leave lamb “consumption” up a forecasted 6 percent higher in the second quarter.

On May 5, the LMIC expected national, direct lamb prices on a carcass basis to range from $305 to $310 per cwt. in the second quarter, 37 percent higher year-on-year. The live-equivalent is about $154 per cwt. LMIC expects 60-90 lb. feeders to range from $225 to $233 per cwt., up 100 percent year-on-year.

Unlike in other U.S. meat industries, lamb imports account for about half of lamb in our retail and foodservice markets. This means that in spite of tight supplies domestically, increased imports can increase total supplies which can weaken domestic prices. However, slaughter rates are high in Australia which means that at some point, U.S. lamb imports could slow as flock rebuilding efforts get underway.

Higher lamb prices will also be supported, in part, by higher beef and pork prices. These proteins are seeing record high prices, and steady demand, thus far. Tight supplies and strong exports are putting pressure on beef prices and in the pork industry, the PED disease and continued high export share have squeezed domestic pork supplies.

Higher-priced meats mean consumers will cut back or trade down in value. Restaurants will look for ways to cut costs. Jim Rob, director of LMIC commented, “White-tablecloth restaurants have adjusted the size of their steaks, making them thinner to offset the price increases,” (Associated Press, 4/20/14). Robb added: “Some places now serve a 6-ounce sirloin, compared to 8- or 10-ounce portions offered years ago. And fast-food restaurants are trimming costs by reducing the number of menu items and are offering other meat options, including turkey.

The Daily Livestock Report (DLR) commented that “the beef and pork industries remain concerned about what could happen to demand for their products should chicken prices remain low — or even decline if chicken output rises. It explains, it is these “relative” prices that impact the demand for a good, not that absolute level of the good’s own price,” (5/5/14).

Value-Based Pricing

In the first trimester, the percent of weekly slaughter that traded on formula was 24 percent compared to an average 29 percent over the past two years. By comparison, the portion of lambs sent to market that are packer-owned rose to 20 percent in the first trimmest, up from 12 percent in 2012 and 2013. The portion of packer-owned slaughter has grown this year at the expense of formula trades and purchases from auctions.

The Lamb Industry “Roadmap” emphasizes value-based pricing as a means to meet consumer demand and expand lamb demand and yet value-based pricing isn’t widely adopted in the lamb industry. In the early 2000s formula pricing accounted for about 45 percent of weekly slaughter, but dropped to under 30 percent by 2013.

There are multiple explanations for this retraction. In general, the formula is not adequately rewarding above-average quality lambs or else more producers/feeders would push for it. If packers are sending their own lambs to the market ahead of formula traded lambs then there is a risk that formula lambs gain weight and thus lose possible price premiums if heavier weighs are discounted. Second, it is possible that packers are not rewarded in the carcass and retail markets for high-quality lambs or else we’d see greater volumes priced under formula.

Unseasonal Slaughter Trends

Last fall, feeder and slaughter lamb prices gained sharply in hopes that the retail market would follow suit, supporting feeder and packer margins. However, by early 2014, feeder and slaughter lamb prices began to backtrack, suggesting the retail market wasn’t going to deliver. In five months through May, slaughter lamb prices at auction lost over $20 per cwt. In the four months since February, feeder lambs in direct trade lost $40 per cwt. Feeder and slaughter lamb prices weakened again in May yet were still sharply higher than a year ago. Was last fall’s run-up a mini-bubble settling at a new, higher plateau?

The seasonal downturn in feeder lamb prices by May was expected, but unexpected for slaughter lambs. Feeder lamb prices exhibit a seasonal pattern due to the seasonal breeding and lambing pattern of sheep. Historically, feeder lamb prices are seasonally highest from December through May and lowest from June through November.

By contrast, the downturn in slaughter lamb prices was unanticipated. Historically, slaughter lamb prices stay high through Easter and the summer when feedlot supplies are the thinnest. Increased supplies at retail, foodservice, from imports and in the freezers has contributed to lower slaughter lamb prices. Lower pelt values also likely helped depress the slaughter lamb market.

Pelts Moved Lower

Pelt prices were down sharply in May, reducing packer margins.

The U.S. Department of Agriculture Agricultural Marketing Service (AMS) reported that increased stocks of old crop pelts in the supply chain and the reduced availability of premium pelts in May reduced international interest  (5/2/14). Lower quality coupled with lower international interest dampened prices. AMS added that as the old crop lambs get cleaned up and the new pelts come to market there is also the concern that the new pelts are muddy.

(5/2/14). Lower quality coupled with lower international interest dampened prices. AMS added that as the old crop lambs get cleaned up and the new pelts come to market there is also the concern that the new pelts are muddy.

Fall clips averaged $7.75 per piece in May, down 15 percent monthly and 32 percent weaker year-on-year. No. 1 pelts were $6.10 per pelt, down 18 percent monthly and 30 percent lower from a year ago. Imperial pelts saw $9.80 in May, 11 percent lower monthly and 27 percent lower year-on-year.

Forecasts

In early June, the Livestock Market Information Center (LMIC) estimated that national slaughter lamb prices in direct trade could average $315 to $325 per cwt. on a carcass basis, up 35 percent year-on-year.

Feeder lamb prices for 60- to 90-lb. feeders in 3 markets (Colorado, South Dakota and Texas) were estimated at $205 to $215 per cwt., up 84 percent.

Forecasts are conditioned by the retail import and domestic supply situation and whether lamb demand is expanding.

Corn Sharply Lower Year-on-Year

By early June, Omaha corn averaged $4.72 per bu., 30 percent lower year-on-year. In early May, however, corn pushed above $5 per bu. in some areas which might have contributed to lower feeder lamb prices. AMS commented, “Corn has shown some modest increases in the past month or so. A decreasing slaughter lamb market and slightly higher cost of gain in the feedlot is forcing feeders to lower their bids on feeder lambs. There is an adequate supply of market ready lambs from Colorado to the Midwest,” (5/2014).

Alfalfa ended its marketing year in April averaging $198.50 per ton, down 6 percent year-on-year. Other hay was $139.83 per ton, 3 percent lower year-on-year. In some areas of the West hay production commenced by early June with Colorado hay being put up in the southeast and northeast and California hay production in full swing in most regions.

Feeder Lamb Prices

Feeder lamb prices at auction were sharply higher than direct sales in May. Direct trade feeder lamb prices primarily reflect purchases by the largest commercial feeders whereas the higher, auction prices might also reflect direct-to-consumer purchases.

The 3-market (CO, SD, TX) average for 60-90 lb. feeders was $194.20 per cwt., down 2 percent in May and 67 percent higher than a year ago.

In San Angelo the auction average was $165.17 per cwt., down 12 percent, and at auction in Sioux Falls prices slumped 2 percent to $223.24 per cwt.

In May, feeder lambs in direct trade averaged $158.29 per cwt., 9-percent lower monthly and 57 percent higher year-on-year. Prices averaged 22 percent higher than the 5-year May average.

Slaughter Lamb Prices

Slaughter lamb prices weakened in May yet were significantly higher than a year ago. Increased domestic and imported lamb supplies, higher cold storage supplies and ultimately a stagnant retail market likely put a damper on the slaughter lamb market. As summer lamb sales begin to rise with warmer weather, reduced stocks will likely lend price support. In May, slaughter lamb prices at auction slumped 4 percent to land at $141.70 per cwt. In spite of the monthly drop, auction averages were 44 percent higher than a year ago and 12 percent higher than its May 5-year average.

Prices were mixed across sheep auctions. Prices at auction in Kalona, Iowa jumped 3 percent to average $158.50 per cwt. Slaughter lamb prices at Producers Livestock Auction in San Angelo saw an 8-percent drop in May to $136.63 per cwt. Prices in South Dakota fell nearly 1 percent to $148.25 per cwt.

In May, slaughter lamb prices in direct trade on a carcass-based formula averaged $281.76 per cwt., down 4 percent monthly (live-equivalent of $140.54 per cwt.) Slaughter lamb prices on formula were 27 percent higher than a year ago.

In the slaughter lamb trade on a value-added formula the percentage of heavier lambs has grown sharply since last fall. Last fall slaughter was very current and prices climbed in a hurry. Last fall, we didn’t see any lambs over 85 lbs. in formula trades; however, this spring that percent jumped to 40 percent.

In the live, negotiated trade, slaughter lamb prices averaged $146.16 per cwt., down 7 percent monthly and 23 percent higher than a year ago.

Equity Electronic auction reported one sale each for April and May with prices gaining $0.50 per cwt. to $135.50 per cwt. in May.

The downturn in lamb prices during early spring is a concern. In 2000 through 2013, slaughter lamb prices at auction increased toward the high-demand Easter period and stayed high over the summer months when feedlot supplies were the thinnest. Prices trended lower in July through mid-fall before seeing gains toward December as the end-of-the-year holidays approach.

Slumping slaughter lamb prices and climbing weights in May suggested that slaughter was getting backed up. This implies that lambs that are market-ready are continuing on feed.

Meat Market Lower

The net carcass value (after processing and packaging costs are subtracted) averaged $333.26 per cwt. in May, down 2 percent monthly and 32 percent higher year-on-year. All primals saw lower price points in May.

The lower loins, in particular, was a surprise for it typical strengthens as the summer grilling season approaches. This May, the loin, trimmed 4×4, lost 2 percent to $479.34 per cwt. yet was 6 percent higher year-on-year. The 8-rib rack, medium, was also 2-percent lower at $807.32 per cwt. yet up year-on-year by 61 percent. The leg, trotter-off, averaged $375.01 per cwt., down 2 percent monthly and up 20 percent from a year ago. The shoulder, square-cut, saw a 1 percent drop in May and a 28-percent gain over a year ago.

Ground lamb saw only a 0.30 percent slip monthly to $527.07 per cwt., down 1 percent from a year ago.

The rack, roast-ready, frenched averaged $1,527.76 per cwt. in May, down 0.4 percent monthly and up 27 percent year-on-year. By comparison, the Australian imported rack, cap-off, averaged $1,108.26 per cwt., up 9 percent monthly and 22 percent higher year-on-year.

The carcass market gained $12 per cwt. over the three months to Easter, saw an Easter spike and then dropped sharply to levels not seen since February. Carcass prices averaged $309.85 per cwt. in May, down 3 percent monthly and 24-percent higher year-on-year.

The National Restaurant Association survey found positive restaurant performance in April which bodes well for meat demand this spring and summer (Daily Livestock Report (DLR), 6/4/14). Restaurant foot traffic increased 3.2 percent from late 2013 indicating “robust expansion,” (6/4/14). Increased foot traffic means more people are eating out. The Daily Livestock Report (DLR) added that it expects foodservice sales to only improve during early summer.

Packer-Owned Slaughter Up

Through May, the percent of total weekly federally-inspected slaughter that was owned by packers was 20 percent, compared to 13 percent annually in 2009 through 2013.

It appears that packer-owned slaughter is in direct competition with value-added formula purchases. The percent of slaughter that was sold on a value-added formula was 23 percent through May compared to a 31 percent 5-year average.

The fact that packer-owned slaughter has beControlling an increased share of inventory through packer ownership or marketing agreements with producers reduces packer risks. Packers can face volatile markets at both ends: by retailers and wholesalers and also by feeders on the input side. It is unknown for certain, but packers might have better success minimizing input price risk by owning lambs than managing sales risk when up against concentrated retail and foodservice giants such as Wal-Mart and Sysco.

The Livestock Market Information Center (LMIC) reported in late May: Additional price support (at retail) has come from higher prices of meat from steers and heifers, and those of pork and poultry. In recent weeks, wholesale cull cow-beef values have averaged about 22 percent above a year ago, tight supplies of cattle have caused packers to bid aggressively pulling live cull cow prices in most markets up 30 percent from 2013. Year-over-year those percentage gains should persist for the balance of 2014, however the normal seasonal price drop is expected into the fall months, (LMIC, 5/30/14).

The Livestock Market Information Center (LMIC) reported in late May: Additional price support (at retail) has come from higher prices of meat from steers and heifers, and those of pork and poultry. In recent weeks, wholesale cull cow-beef values have averaged about 22 percent above a year ago, tight supplies of cattle have caused packers to bid aggressively pulling live cull cow prices in most markets up 30 percent from 2013. Year-over-year those percentage gains should persist for the balance of 2014, however the normal seasonal price drop is expected into the fall months, (LMIC, 5/30/14). (5/2/14). Lower quality coupled with lower international interest dampened prices. AMS added that as the old crop lambs get cleaned up and the new pelts come to market there is also the concern that the new pelts are muddy.

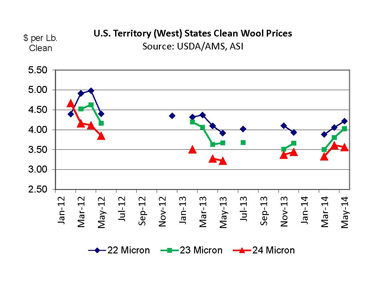

(5/2/14). Lower quality coupled with lower international interest dampened prices. AMS added that as the old crop lambs get cleaned up and the new pelts come to market there is also the concern that the new pelts are muddy. Indicator (EMI) price of wool is projected to increase to around 1155 cents a kilogram in 2015–16 (in 2013–14 dollars), before declining slightly toward 2018–19, (ABARE, March 2014).

Indicator (EMI) price of wool is projected to increase to around 1155 cents a kilogram in 2015–16 (in 2013–14 dollars), before declining slightly toward 2018–19, (ABARE, March 2014).