By Julie Stepanek Shiflett, Ph.d.

Juniper Economic Consulting

June 2014

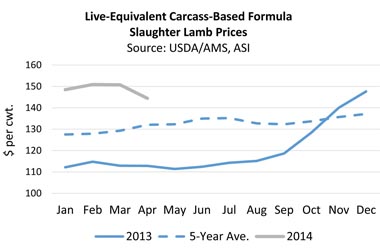

“The slaughter lamb prices are trending down. With no clear level as to where demand is willing to participate, it is uncertain as to how long this correction will carry on,” reported the U.S. Department of Agriculture Agricultural Marketing Service in early May. In an unseasonal upset, slaughter lamb prices trended down in April and market weights gained. Historically, slaughter lamb prices gain at least through mid-summer before seeing any downturns.

There are likely ample supplies of market-ready lambs in feedlots with a reported minimum of three times the volume of lambs in Colorado feedlots this spring compared to last. The drought in California prompted the flow of new crop lambs earlier than usual. While these lambs are not yet ready for market, the concern is the uncertain volume of old crop lambs yet to be “cleaned up.”

The market has done a good job of moving lambs with weekly slaughter rates over 50,000 head for Easter and an estimated 6 percent higher slaughter in the four weeks preceding Easter compared to a year ago. However, the higher percentage of packer-owned lambs in the mix is likely contributing to the slowdown in old crop marketings and hence weight gains. Market weights averaged 160 pounds for formula sales in April, with many lambs hitting over 190 pounds. Further exacerbating the situation is that lamb demand likely remains sluggish and freezer inventories hit yet another record high. Hopefully old crop lambs can be sent to market by the end of May which could support prices this summer in a typically lean-supply period.

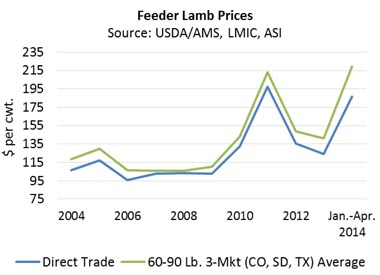

Commercial Feeder Lamb Prices Down

The weakening slaughter lamb market likely incited feeders to lower offers on feeder lambs with prices falling about 7 percent monthly.

In general, lower cost of gain by lambs in feedlots supports feeder lamb prices, but the recent lower slaughter lamb market and increased corn usage by the livestock industry adds risk. Reportedly, drier conditions in Colorado feedlots dropped the cost of gain from around $1.50 per pound for some in February and March down to a low of about $1.10 per pound by April. The cost of gain could move lower or higher in coming months depending upon corn price projections.

In April corn averaged $4.98 per bu. in north central Colorado, 3 percent higher monthly and 25 percent lower than a year ago. In early May, corn futures out 3, 6 and 9 months held just under $5 per bu. on the Chicago exchange. Also in early May, corn planting were ahead of last year’s schedule but still behind the 5-year average. If corn isn’t planted by mid-May, forecasted yields move lower. In the 2014/15 September through August corn marketing year, the USDA Economic Research Service forecasted corn could range from $4.40 to $4.80 per bu.

Many new crop lambs from California were sent to Colorado feedlots early and at lighter weights than normal. These lambs will not likely be market-ready until the summer. The Daily Livestock Report commented that in total livestock industries are feeding more corn than the number of animals would suggest. If corn is relatively lower-priced and many areas of country are dry, corn usage might be up “even though that may mean worse feed-meat conversions.” Feeder lamb prices in direct trade averaged $174.58 per cwt. in April, down 6 percent monthly, but 78 percent higher year-on-year. After trading over 20,000 head in February, the volume of lambs in direct feeder lamb trade dropped to 8,100 head in April.

Feeder lamb prices at auction were down 8 percent monthly in April to averaged $207.68 per cwt., and up 73 percent year-on-year. Prices in San Angelo for 60- to 90-pound feeders were $193.75 per cwt., 9 pecent lower monthly and averaged $221.60 per cwt. in Sioux Falls, down 2 percent monthly.

Commercial Slaughter Lamb Prices

There has been a marketing shake-up this year: the volume of packer-owned slaughter in weekly marketings was up 87 percent in the first trimester year-on-year, formula sales – awarding premiums and discounts based upon quality and weight – were off 24 percent and live, negotiated purchases were up 38 percent.

Lower volume of lambs demanded from one marketing method or another can affect relative prices. Lower quantity demanded of formula lambs could mean lower prices. Higher quantity demanded of negotiated prices could explain prices the $13 per cwt.-higher prices observed over formula trades. Among marketing methods, formula trades averaged lowest.

At $291.84 per cwt., slaughter lamb prices on a carcass-based formula were down 4 percent monthly and still up 29 percent year-on-year. The live-weight equivalent was $144.46 per cwt.

The live, negotiated average in April was $157.75 per cwt., 2 percent lower monthly and up 36 percent year-on-year.

At auction, slaughter lambs lost 6 percent to $148.34 per cwt. In spite of the weakening, April’s average was still 50 percent higher year-on-year and 17 percent higher than the 5-year average for the month.

In San Angelo live, slaughter lamb prices averaged $147.88 per cwt., down 5 percent; prices averaged $149.44 per cwt. in South Dakota, down 5 percent and in Kalona, Iowa prices averaged $154.17 per cwt., down 2 percent monthly.

Lamb in the Freezers Up

In late April, the Livestock Market Information Center (LMIC) reported that lamb was the only protein to see a large increase in freezer inventory in March (up 59 percent year-on-year). Tight supplies of veal, beef and pork helped reduce respective cold storage inventories.

LMIC reported, “High frozen inventory levels generally mean that product is being stored for future use (domestic and exports). The low inventory levels across meat products is the result of tight supplies, most importantly reduced beef production, caused by herd liquidation in recent years; and the PED virus shrinking hog numbers. For dairy products inventory has being pulled ahead to fulfill current needs, including exports. The only sector with a price depressing overhang of frozen product is the lamb industry.” Hopefully the May report will show dramatic decrease, meaning lamb was moved out for the Easter and Passover holidays.

Commercial Wholesale Market

The lamb wholesale market continued be sluggish in April with few gains. The net carcass value (the wholesale composite after packaging and processing costs) averaged $338.59 per cwt., down .06 percent monthly and up 32 percent from year ago. The lamb primals were mostly unchanged in April with the only real movement coming from loins. It is not unusual for the leg and rack to lose some value seasonally following Easter. In May we typically see the loins gain traction, gearing up for the grilling season.

The loins, trimmed 4 x 4, saw a 2 percent gain monthly to $488.10 per cwt., up 8 percent year-on-year. The rack, 8-rib, medium, was up 0.2 percent to $822.72 per cwt., 61 percent higher year-on-year. The shoulder, square-cut, averaged $298.14 per cwt., down 1 percent in April and up 26 percent from a year ago. The leg, trotter-off, dropped 1 percent in April to $382.37 per cwt., up 19 percent year-on-year. Ground lamb lost 1 percent in April to $528.68 per cwt., virtually unchanged from a year ago. In the carcass market, prices averaged $319.88 per cwt., 2 percent higher monthly and up 29 percent from a year ago.

Pelt Market Weaker

Slaughter lamb prices have not received much support from the weaker pelt market. Packers received $6.86 per piece on average for pelts in April, down 7 percent monthly and down 32 percent from a year ago.

AMS reported, “Many lower quality old crop pelts were noted in the supply with fewer premium pelts available,” (5/2/14). Old crop pelts and wool get brittle as they age.

Previously shorn Imperial Fall Clips received just over $11 per piece while Fall Clips and No. 1s received $9.13 and $7.41 per pelt, respectively. Lambs that are growing shorn pelts might have to be sent to market before the wool has had a chance to grow sufficiently to receive top dollar. Never shorn Californians received $11.13 per piece.

The international pelt market has seen a slow down due to the closure of some Chinese tanneries because of groundwater pollution. Some U.S. pelts are also exported to Turkey yet, reportedly, the offerings are lower.

Midwest and Eastern Lamb Market

Sheep numbers are on the rise commented a marketing manager at Mt. Hope Auction, Mt. Hope, Ohio. The auction sells about 900 lambs per week for direct slaughter to buyers of varying backgrounds. AMS reports prices from 14 sheep auctions across the U.S., eight of which are in the Midwest and East. There are important sheep auctions is many eastern states, serving the important function of bringing buyers and sellers together to benefit from fair and competitive price discovery.

Not unlike other auctions, Easter sales are not necessarily the higher-priced period of the year at Mt. Hope. This year producers received up to $1 per pound more during February and March compared to April. In New Holland, – the largest eastern auction – Easter shipments of lambs from Texas and the West can flood the market and depress prices.

Mt. Hope sells lamb of all weights up to about 130 pounds. In the last week of April 80-100 lb. lambs brought up to $225 per cwt., 100-130 pounds averaged up to $185 per cwt. while lambs weighing about 130 pounds averaged in the high $160s per cwt.

In Lancaster, Pennsylvania at the New Holland market, the bulk of the highest-quality lambs weighed between 60 and 70 pounds and averaged $215.76 per cwt. in early May. Prices were $10 to $15 per cwt. lower weekly on heavier supplies. The heaviest lambs – up to 130 pounds – averaged $230 per cwt. in thin trade.

Retail Easter Prices Up

During Easter, AMS explained, leg items were the most popular featured items, as the “majority of the retailers showed some sort of lamb items in their weekly circular and published higher week-to-week sale prices.”

Following Easter, AMS reported “the emphasis clearly moved from leg items for Easter to the shoulder and loin complex for the upcoming grilling season. Pricing on the majority of lamb items was steady to firm. By the first week of May, the main featured items continued to be shoulder chop items and loin chops at $1 per pound lower prices. Lamb legs were the third most featured item at $1 per pound higher weekly.

During Easter, bone-in legs were featured at $5.98 per pound compared to $5.02 per pound a week earlier and $7.99 per pound a year ago. The boneless leg was offered at $6.83 per pound., compared to $6.44 per pound a week earlier and $6.99 per pound a year ago. The semi-boneless leg saw $5.51 per pound, up from $5.23 per pound a week earlier and no comparison to a year earlier.

Western U.S. Drought Intensified

In late April, the U.S. Drought Monitor reported intensified dryness in seven western and central states. In the same report, all of California was in moderate to exceptional drought for the first time in the report’s 15-year history.

The cost of the drought in California is estimated at least $7.48 billion in direct and indirect costs, according to Mike Wade, executive director of the California Farm Water Coalition (USA Today, 4/25/14). As the U.S.’s second largest sheep-producing state what are the costs to the sheep industry? Fall-born Californian lambs are put on pastures early in the spring before going to market in late spring and summer.

Reduce forage availability means increased purchased feed costs either in traveling greater distances or buying hay and grain, or as we’ve seen, in early sell. In addition, poor nutrition to ewes might have lasting affects in reduced productivity.

Chilled Imports on the Rise

In the four months through April, lamb imports from Australia were up 15 percent year-on-year to 33 million pounds. Within Australia’s total, 64 percent was chilled, rather than frozen product. At the beginning of April, 28 million pounds of lamb and mutton, domestic and imported, sat in U.S. freezers. Stocks were 7 percent higher monthly and 59 percent higher year-on-year. Lamb importers might have to place orders up to two months in advance of arrival and under uncertain market conditions which might explain imports in our freezers.

Forecasts

In late April, the LMIC forecasted that domestic production could increase 3 percent in the second quarter and imports could fall 2 percent quarterly. The result is an expected 11 percent quarterly gain in total lamb availability (including the large volume of freezer inventory that carries into the second quarter). Exports and remaining ending stocks in the freezers will reduce this volume to some extent but still leave lamb “consumption” up a forecasted 6-percent higher in the second quarter.

On May 5, the LMIC expected national, direct lamb prices on a carcass basis to range from $305 to $310 per cwt. in the second quarter, 37 percent higher year-on-year. The live-equivalent is about $154 per cwt. LMIC expects 60-90 lb. feeders to range from $225 to $233 per cwt., up 100 percent year-on-year.

Unlike in other U.S. meat industries, lamb imports account for about half of lamb in our retail and foodservice markets. This means that in spite of tight supplies domestically, increased imports can increase total supplies which can weaken domestic prices. However, slaughter rates are high in Australia which means that at some point, U.S. lamb imports could slow as flock rebuilding efforts get underway.

Higher lamb prices will also be supported, in part, by higher beef and pork prices. These proteins are seeing record high prices, and steady demand, thus far. Tight supplies and strong exports are putting pressure on beef prices and in the pork industry, the PED disease and continued high export share have squeezed domestic pork supplies.

Higher-priced meats mean consumers will cut back or trade down in value. Restaurants will look for ways to cut costs. Jim Rob, director of LMIC commented, “White-tablecloth restaurants have adjusted the size of their steaks, making them thinner to offset the price increases,” (Associated Press, 4/20/14). Robb added: “Some places now serve a 6-ounce sirloin, compared to 8- or 10-ounce portions offered years ago. And fast-food restaurants are trimming costs by reducing the number of menu items and are offering other meat options, including turkey.

The Daily Livestock Report (DLR) commented that “the beef and pork industries remain concerned about what could happen to demand for their products should chicken prices remain low — or even decline if chicken output rises. It explains, it is these “relative” prices that impact the demand for a good, not that absolute level of the good’s own price,” (5/5/14).

Value-Based Pricing

In the first trimester, the percent of weekly slaughter that traded on formula was 24 percent compared to an average 29 percent over the past two years. By comparison, the portion of lambs sent to market that are packer-owned rose to 20 percent in the first trimmest, up from 12 percent in 2012 and 2013. The portion of packer-owned slaughter has grown this year at the expense of formula trades and purchases from auctions.

The Lamb Industry “Roadmap” emphasizes value-based pricing as a means to meet consumer demand and expand lamb demand and yet value-based pricing isn’t widely adopted in the lamb industry. In the early 2000s formula pricing accounted for about 45 percent of weekly slaughter, but dropped to under 30 percent by 2013.

There are multiple explanations for this retraction. In general, the formula is not adequately rewarding above-average quality lambs or else more producers/feeders would push for it. If packers are sending their own lambs to the market ahead of formula traded lambs then there is a risk that formula lambs gain weight and thus lose possible price premiums if heavier weighs are discounted. Second, it is possible that packers are not rewarded in the carcass and retail markets for high-quality lambs or else we’d see greater volumes priced under formula.

In April corn averaged $4.98 per bu. in north central Colorado, 3 percent higher monthly and 25 percent lower than a year ago. In early May, corn futures out 3, 6 and 9 months held just under $5 per bu. on the Chicago exchange. Also in early May, corn planting were ahead of last year’s schedule but still behind the 5-year average. If corn isn’t planted by mid-May, forecasted yields move lower. In the 2014/15 September through August corn marketing year, the USDA Economic Research Service forecasted corn could range from $4.40 to $4.80 per bu.

In April corn averaged $4.98 per bu. in north central Colorado, 3 percent higher monthly and 25 percent lower than a year ago. In early May, corn futures out 3, 6 and 9 months held just under $5 per bu. on the Chicago exchange. Also in early May, corn planting were ahead of last year’s schedule but still behind the 5-year average. If corn isn’t planted by mid-May, forecasted yields move lower. In the 2014/15 September through August corn marketing year, the USDA Economic Research Service forecasted corn could range from $4.40 to $4.80 per bu.