AMS explained that raw wool demand was good in late May.

“Interest in selling wool has still been high. Another rally has really peaked interest at this time and has been conducive to an active market, making growers more willing to sell wool,” (5/29/15). Expectations of lower wool supplies worldwide – from grower through the supply pipeline – spurred a lot of the recent activity.

Eamon Timms, wool brokerage manager for Fox and Lillie, said demand was strong from Indian and Chinese buyers. Timms continued, “Some of the buyers had ‘buy at best’ orders, which basically means do not stop bidding until you get the wool,” (ABC Rural, 6/1/15). “The fashion houses are using more wool, there is stronger demand for knitted fabrics, and U.S. and European consumers are looking at woolen fabrics in a more favorable light,” explained Rabobank analyst Georgia Twomey (ABC Rural, 6/1/15).

At the end of May, AMS reported that wool trades saw western wools trade at rates mostly between 80 to 85 percent of Australia with some of the lower micron wools (finer wools) trading as high as 90 percent (5/29/15). Midwestern wools saw an increase as well, trading between 75 to 85 percent of Australia, with the majority at the 80 percent range.

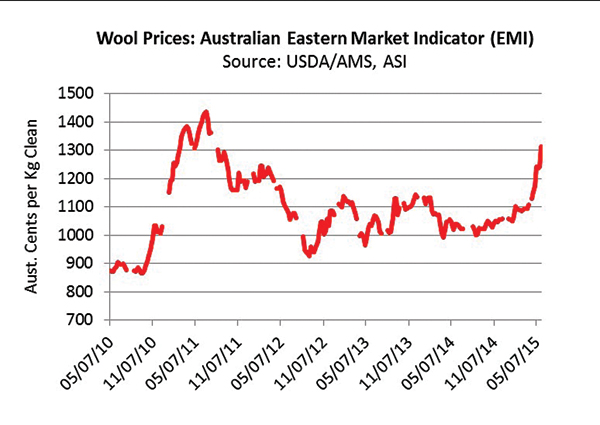

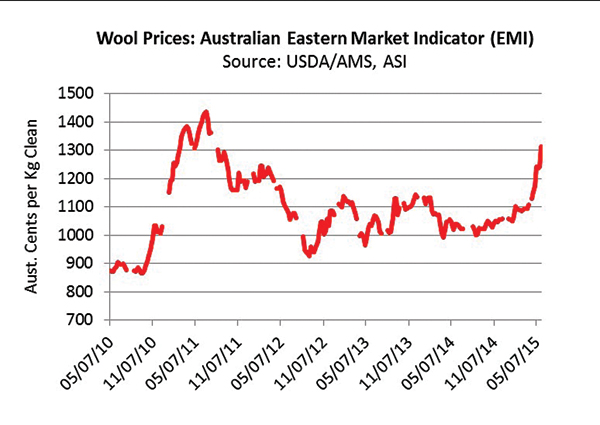

In early May, the Australian market rallied. During the five trading weeks of May, the Australian Eastern Market Indicator (EMI) jumped 11 percent from $1,172 to $1,312 Australian cents per kg clean. At the end of May, the EMI was 26 percent higher than a year ago and at a four-year high.

In early May, AMS explained that in the U.S. the rally had some wool growers holding tighter to their wool, to see how high it (prices) could go before deciding to sell. However, by the end of May the report tone changed. AMS explained, “Currency and optimism overseas have been the biggest contributors to the (domestic) rally,” 5/15/15.

In general, the U.S. dollar is very strong relative to the Australian dollar, but a little respite in early May, when the U.S. dollar rose from 76 cents per Australian dollar to 80 cents, helped boost the U.S. wool market.

This year’s yields were improved over last year, except for those drought-hit pockets across the west. Dirt penetration in the wools from a dry winter and spring can reduce wool yields. Yield is the amount of clean wool produced from raw (or grease) wool in the scouring process.

Mike Corn, Roswell Wool manager, commented that thus far he has seen less polypropylene and hair sheep contamination than in the past (6/8/15). However, there is still wool out there for rains slowed shearing across parts of Utah, Idaho and Wyoming.

In general, the coarser U.S. wools received higher prices than a year ago while the mid-micron to finer wools were down anywhere from 0.4 to 12 percent year-on-year.

In the Fleece States (Midwestern and some Californian wools) 22 micron averaged $3.54 per lb. in May, up 15 percent monthly and 10 percent lower year-on-year. Twenty-three micron averaged $3.31 per lb. clean, 24 micron averaged $3.10 per lb., and both were down about 10 percent year-on-year. Twenty-five micron brought $3.05 per lb. clean, up 11 percent monthly and up 0.5 percent from a year ago. Twenty-six micron averaged $2.73 per lb. clean, down

6 percent from a year ago.

In the Territory States (western and some California wools), the finer 19 micron brought $4.28 per lb. clean, 20 micron averaged $4.20 per lb., 21 micron averaged $3.86 per lb., 22 micron brought $3.70 per lb., 23 micron brought $3.48 per lb., 24 micron averaged $3.33 per lb., 25 micron averaged $3.19 per lb., 26 micron averaged $2.97 per lb. and 27 micron averaged $2.76 per lb. clean.

AMS explained that clean prices reported are FOB warehouse (grower delivers) in original bag or square pack, bellies out, some graded, and 76 mm or longer. Further, no allowance is made for coring, freight or handling fees at the warehouse level to reflect actual prices growers receive. Wools shorter than 75 mm typically are discounted 10 to 20 cents per lb. clean. Classed and skirted wools usually trade at a 10 to 20 per lb. clean premium to original bag prices.

Many wool market observers expect that the market will “remain at strength until global mill stocks are replenished” (woolnews.net from AWI, 5/29/15). As South African and South American seasons draw to an end, there will be increased pressure on Australia’s tight supply in coming weeks.

Targeting high-value markets can be key to achieving higher margins for lamb operators. In general, grocery store prices are double manufactures’ prices and restaurant prices are more than 200 percent higher (U.S. Department of Agriculture, 12/1/14). The U.S. rack – featured mostly in restaurants – is nearly double the price of the Australian rack. The U.S. rack is larger than the comparable Australian cut, but the difference in price is significant, suggesting that the larger margins afforded restaurants may also allow them to pay more for lamb.

Targeting high-value markets can be key to achieving higher margins for lamb operators. In general, grocery store prices are double manufactures’ prices and restaurant prices are more than 200 percent higher (U.S. Department of Agriculture, 12/1/14). The U.S. rack – featured mostly in restaurants – is nearly double the price of the Australian rack. The U.S. rack is larger than the comparable Australian cut, but the difference in price is significant, suggesting that the larger margins afforded restaurants may also allow them to pay more for lamb. Eamon Timms, wool brokerage manager for Fox and Lillie, said demand was strong from Indian and Chinese buyers. Timms continued, “Some of the buyers had ‘buy at best’ orders, which basically means do not stop bidding until you get the wool,” (ABC Rural, 6/1/15). “The fashion houses are using more wool, there is stronger demand for knitted fabrics, and U.S. and European consumers are looking at woolen fabrics in a more favorable light,” explained Rabobank analyst Georgia Twomey (ABC Rural, 6/1/15).

Eamon Timms, wool brokerage manager for Fox and Lillie, said demand was strong from Indian and Chinese buyers. Timms continued, “Some of the buyers had ‘buy at best’ orders, which basically means do not stop bidding until you get the wool,” (ABC Rural, 6/1/15). “The fashion houses are using more wool, there is stronger demand for knitted fabrics, and U.S. and European consumers are looking at woolen fabrics in a more favorable light,” explained Rabobank analyst Georgia Twomey (ABC Rural, 6/1/15).