- September 2015

- President’s Notes

- Producers Testify in Wyoming

- Let’s Grow Announces Second Round of Funding

- Lone Star State Celebrates Two Anniversaries

- Helle Wins Preliminary Battle in Federal Grazing Lawsuit

- Lamb Jam Master To Be Decided in New York

- Fibrelux Shows Value in Early Tests in San Angelo

- Obituaries

- NSIIC Accepting Grant Proposals

- New Research Journal Article Posted

- Market Report

- Sheep News In Brief

- The Last Word

Pricing, Loading Begins for Fall Run

Julie Stepanek Shiflett, Ph.D.

Juniper Economic Consulting

It’s that time of year again, many lamb producers are busy pricing markets and feeders are seeking out supplies. By the time this article goes to print, many producers will be loading lambs destined for commercial feedlots, or to pasture to slow down the rate of gain. Between August and September, nearly half of feeders in direct trade are traded with commercial feedlots at their fullest in October and September.

Finishing lambs in feedlots is a complex puzzle, designing diets to meet target harvest dates, incorporating weigh-in weights and frame size (ability to grow). Feedlot deliveries in July weighed anywhere from 70 to 114 lbs. Heavier lambs will have a shorter finishing time and be provided a high-concentrate diet whereas lighter-weight lambs are initially fed more roughage.

Corn, alfalfa and grass hay are big ticket items for feeders and can affect offer prices. Forecasted slaughter lamb prices are also important. Feeders subtract expected feeding costs and a profit margin from an expected slaughter lamb price and then divide by the finished lamb weight to estimate their price offers. This year, corn could move higher, lowering offers, and the slaughter lamb market is uncertain. Historically, slaughter lamb prices trend higher from the summer through fall; but this year an oversupply of older, overfinished lambs, possible lower beef prices and strong lamb imports – due to the strong U.S. dollar – could temper this gain.

Corn, alfalfa and grass hay are big ticket items for feeders and can affect offer prices. Forecasted slaughter lamb prices are also important. Feeders subtract expected feeding costs and a profit margin from an expected slaughter lamb price and then divide by the finished lamb weight to estimate their price offers. This year, corn could move higher, lowering offers, and the slaughter lamb market is uncertain. Historically, slaughter lamb prices trend higher from the summer through fall; but this year an oversupply of older, overfinished lambs, possible lower beef prices and strong lamb imports – due to the strong U.S. dollar – could temper this gain.

In late July, the U.S. Department of Agriculture Agricultural Marketing Service reported that “old crop lambs in Colorado should be finished at the harvest facilities within the next one to two weeks. As those clean up out of the feed yards, it will leave more empty space to fill with new lambs,” (7/31/15). AMS continued: Lack of demand and imports/currency are the main focus at this point in time.

Feeder Lambs Mixed

At auction, 60-90 lbs. feeders averaged $191.67 per cwt. in San Angelo, about steady with June and 10 percent lower year-on-year. In Sioux Falls, feeders averaged $199.83 per cwt., down 5 percent monthly and 3 percent lower year-on-year.

In direct trade, prices averaged $174.19 per cwt., up 10 percent monthly and 5 percent higher year-on-year. Close to 4,000 head traded out of California at 85 lbs. for $172 per cwt.

Seasonally, feeder lamb prices are lowest from June through November and then the highest from December through May. If feeder supplies are relatively short this season, we might see some competition bidding up prices in an effort to secure supplies.

Hay prices are mixed this year depending upon the type of hay and location. The Livestock Market Information Center commented that overall, there is a shortage of high quality “dairy” type alfalfa hay compared to an oversupply of “beef cow” quality hay. Depending upon feeder, lambs might receive a wide range of hay, from lower quality grass to higher quality alfalfa.

Corn prices could move higher on the back of a July USDA estimate that corn acreage was lower than expected and that a wet summer in some key areas could move corn yields lower. A knee-jerk reaction to the acreage report pushed corn forecasts to over $4 per bu., but December corn is coming down marginally to the high $3s.

Slaughter Lambs Mixed

Slaughter lamb prices were mixed in June as live, auction prices came off of Ramadan specials and as we saw increased movement of old crop lambs in feedlots, boosting the demand for new crop lambs.

One average, live, auction prices were $152.34 per cwt., 2 percent lower monthly yet 2 percent higher than a year ago. In June, San Angelo averaged $140.50 per cwt., South Dakota averaged $158.28 per cwt., Kalona, Iowa averaged $156.38 and Equity electronic auction averaged $160.50 per cwt. in its one monthly sale.

Slaughter lambs priced on a carcass-based formula averaged $289.03 per cwt. ($146.59 per cwt. live-equivalent) in June, up 1 percent monthly and up 0.1 percent year-on-year. Carcass weights averaged 89.74 lbs., up 5 percent monthly and up 18 percent year-on-year from 76.37 lbs.

Formula prices will likely lift as old crop lambs get “cleaned up.” In early August, some old crop lambs (born winter and spring 2014) were harvested at about 234 lbs., depressing the market. In July, the difference between the lightest and heaviest lambs trading on formula was over $50 per cwt.

Live, negotiated slaughter lambs averaged $144.71 per cwt. in June, down 1 percent monthly and down 3 percent from a year ago.

Lamb Wholesale Market Higher

At $325.27 per cwt., the net carcass value (wholesale composite after packaging and processing) was up 1.2 percent monthly in July, steady with a year ago. The stronger loin and leg contributed to the gain.

Among primals, the leg, trotter-off, saw the biggest July gain at $343.77 per cwt., up 2 percent monthly and down 2 percent year-on-year. The loin, trimmed 4×4, also saw a July boost, up 1 percent to $525.25 per cwt. and up 4 percent from a year ago.

The 8-rib rack, medium, averaged $736.75 per cwt. in July, 0.14 percent lower monthly and 7 percent lower year-on-year. The shoulder, square-cut, was also lower, $293.03 per cwt., down one-half percent and 1 percent higher year-on-year.

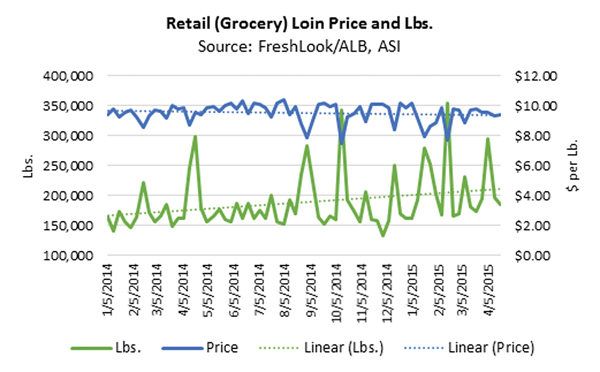

Lamb Retail Prices Flat

Lamb retail prices of key primals plus ground lamb have been relatively flat since 2014. This is somewhat surprising given the potentially price-depressing surge in imports in late 2014 and Easter 2015. Imports might be channeled into freezers and not necessarily adding to grocery or food service supplies. In early July, freezer inventories were down 4 percent monthly, yet up 46 percent year-on-year. Second, imports might replace some domestic supplies at retail that have been diverted to food service thereby leaving grocery supplies unchanged. There is a growing trend of domestic lamb sold direct to restaurants.

Retail prices and lbs. facing consumers at the check-out gives us an improved picture of what’s happening over USDA feature prices. This data private series is available courtesy of the American Lamb Board. Prices paid and the corresponding volume is what allows the industry to estimate lamb demand – as in the recent ALB study. However, only lamb in the aggregate is available, not separated by country of origin. Without domestic and imported prices and volume, market analysis is challenged.

The loin spells out a potentially different story from the national picture. Loin imports increased into 2015 at a wholesale price discount of more than $1 per lb. If more loins are channeled into grocery stores then that could explain the flat to weaker loin price this year. As the loin price held steady and then weakened, lbs. purchased increased. But, lbs. of domestic or imported lamb? We don’t know.

Consumer Sentiment Mixed

In July, job placements were solid, and yet there is lingering sentiment that wages are flat and economic growth is tepid. If the unemployment rate continues to drop, interest rates could begin a gradual rise as early as September.

The restaurant sector remains much healthier than one year ago, but the growth rate is slowing. “The uncertainty of the U.S. economy, challenges in the EU and general volatility appear to be negatively impacting restaurant operators’ views of the future,” (Daily Livestock Report, 8/5/15). However, inflation-adjusted take-home incomes have grown during the last year with a small hiccup in March. In the last 12 months in June, incomes grew 2 percent and were 2 percent higher in June than May.

The beef sector is facing an uncertain demand this fall, which could affect lamb demand and prices. Beef exports are down due to the stronger dollar which can mean increased domestic beef supplies and softer prices. The DLR explained, “So far some of the items that last year were selling at the premium in export markets now have to be absorbed domestically, with prices that in some cases are half of what they were a year ago,” (7/28/15). If beef prices fall, lamb demand could be negatively impacted. A recent demand study by the ALB found that a 1 percent decrease in the price of beef leads to a 0.274 percent decrease in per capita lamb consumption. In general, if lamb demand contracts, so too could prices.

In general, sharply lower pork and chicken prices heading into fall will also likely lead to lower beef demand. This fall, lamb might struggle to find its footing in the rush to stock holiday meats.

Graded Lambs Falls to New Low

In June, the lamb industry hit a new record, only about one-half of lambs inspected in federally-inspected slaughter facilities were graded (45 percent in all commercial facilities). All commercial lamb is USDA inspected; grading is an additional service. The declining trend in graded lamb is likely because: 1. lambs older than one year of age (indicated by the break joint) can’t be graded as lamb, and there have been many of these lambs in the supply channels recently, and 2. the costs of grading likely exceeds the return in sales depending on what accounts processors are sending the meat to. Particularly with the rising popularity of branded lamb products, consumers may not look for USDA prime or choice when buying lamb in some market outlets.

Pelt Market Steady

The U.S. pelt market has been depressed since March 2014. In July, previously shorn Fall Clips pelts held steady at $3.63 per piece, No. 1 pelts averaged $1 per pelt. Never shorn springers lost some footing in July with the low end dropping 50 cents to $3.25 per piece.

We might see some price strengthening this fall. In Australia, by early August, better quality new season lamb skins were receiving solid demand. However, shorn lamb skin prices eased slightly as quality decreased (Meat & Livestock Australia, 8/7/15).

In mid-July New York fashion week for men featured several lambskin jackets, perhaps just what the industry needs to see a turnaround in the pelt market. “Building on a growing public appetite for men’s fashion, the industry is putting on the first stand-alone men’s fashion week in New York in nearly two decades,” (Associated Press, 7/14/15). One jacket was an indigo dyed lambskin varsity jacket; another, a soft lambskin jacket with silk-linen sleeves.

Shorn lambskin prices plummeted in 2014 on the back of China’s shutdown of polluting tanneries and a weakening Russian economy.

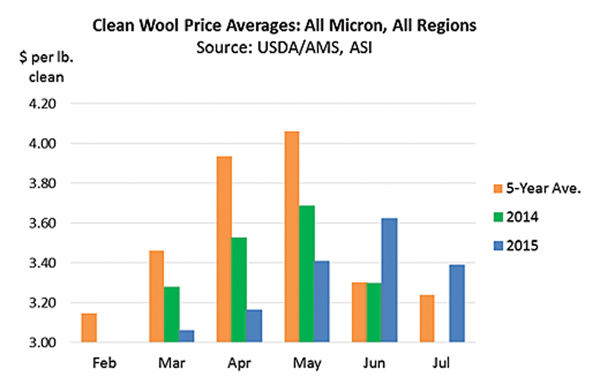

Australian Wool Market Rebounded

The U.S. wool season drew to a close in June with most shearing completed as small wool lots were collected by regional warehouses for fall sales. In the West, 22 micron averaged $3.69 per lb. clean, 23 micron was $3.53 per lb. clean, 26 micron was $2.95 per lb. Prices were about 5 percent softer monthly and about 13 percent lower for the mid-micron wool while 11 percent higher for the 26 micron wool. AMS reported that by the end of July larger wool warehouses were beginning to deliver wool bought previously in the season (7/31/15).

In Australia – and reflected in the U.S. market – this year’s wool market started off slow, rallied from early spring to about mid-June, dropped for 5 consecutive weeks prior to its 3-week recess, then rallied 3 percent. The post-recess rebound might be attributed to the lowest volume offered following a season-end recess in more than 10 years. Most support during the week was directed at the 19- to 21-micron range, which rose as much as 60 Australian cents clean compared to the average of 37 cents (AWEX, 8/6/15).

In Australia – and reflected in the U.S. market – this year’s wool market started off slow, rallied from early spring to about mid-June, dropped for 5 consecutive weeks prior to its 3-week recess, then rallied 3 percent. The post-recess rebound might be attributed to the lowest volume offered following a season-end recess in more than 10 years. Most support during the week was directed at the 19- to 21-micron range, which rose as much as 60 Australian cents clean compared to the average of 37 cents (AWEX, 8/6/15).

First stage wool processors were generally pleased with this year’s clip. One processor commented that U.S. wool quality has been improving every year for the last 10 years.

Wool yields were generally average to cleaner this year. In higher rainfall areas such as in Texas and parts of Colorado, yields were higher. One significant wool buyer called this a “pre-rinse.”

The strong U.S. dollar relative to the Australian dollar meant that U.S. wool growers were not paid as much as if the U.S. to Australian exchange rate was closer to parity (1-to-1). Internationally, the Australian wool market was 22 percent higher in August year-on-year, but in U.S. dollars it was 4 percent lower (AWEX, 8/6/15).

Polypropylene contamination occurs on occasion, but less so than in the past.

Medullated fibers from hair sheep continues to be a processing problem for some, but not others. Reportedly, many Texas sheep growers have gone out of business in the last few years. But many have started to rebuild – with Dorpers. In the last three years, the sheep and lamb inventory in Texas has jumped 8 percent. The USDA doesn’t keep records on the numbers of wool breeds versus hair breeds, but reportedly, some ranchers are raising both wool breeds together with Dorpers or even cross-breeding the two. Either way, hair contamination often occurs in a grower’s wool clip.

From the growers’ perspective, the presence of medullated fiber can mean the wool is rejected outright. From the processors’ point of view, one bag of contaminated wool – if not caught – can ruin thousands of pounds of wool when comingled in processing. In general, large wool clips don’t face this problem and neither do reputation wools where the grower has earned a reputation for a contaminate-free clip.

Black fiber contamination remains a problem for some clips and a concern of processors. In the commodity market, wool that has dark fibers is of lower value because it can’t accept dye as well. As a result, the fabric cannot be used for “light shades” and is more limited in its use.

In contrast, in many niche markets, colored fibers are very desirable, as many hand spinners and weavers prefer natural colors (Schoenian, S., 2015). Contrary to hair contamination, black fiber contaminated wool still has value, but reduces the value of the clip and can only be used in dark shade fabrics or other lower priced products, such as industrial uses .