To View the July 2020 Digital Issue — Click Here

ASI Continues to Fight for American Sheep Industry

Benny Cox, ASI President

We have now gone through the first round of signup for the stimulus package with the U.S. Department of Agriculture after finally getting the rules set forth. Many have been dissatisfied with the payouts and that is just human nature, I guess. I can promise you all that if ASI had not stayed on top of this with USDA, sheep producers might have been left out in the cold.

I saw many publications as payments were being suggested or discussed and lamb or wool were often not listed – even by USDA. This again is why everyone in our industry needs to be supportive of their state and national organizations. The $17 million lamb purchase has seen its first bids accepted and there is plenty of money remaining for more rounds. There will almost certainly be another stimulus round, and suggestions are now being drawn up for our request to USDA.

One of the questions is why the inventory is shutoff at two years of age on sheep and not on older cattle. I would suggest that producers and feeders share their individual situation with their congressional delegations. The Farm Service Agency offices should be well versed now on any signup – be it wool or lamb – since they began enrolling people on May 26.

Our lamb processors are working to get back up to speed, especially in the Northeast where there were so many closures due to the high rate of infection. It seems that Superior Farms lamb processing never went backwards due to all this mess, most likely due to their management group addressing potential problems and putting safeguards in place. Rick Stott and I have been on many of the same conference calls lately, and in his words even though the traditional market lost 50 percent of its business when hotels, restaurants and cruise lines shut down we have seen an increase in retail demand. Rick also pointed out that there are people who have never eaten lamb that have now tried lamb for the first time. You know something good might come out of that. Hopefully, it will increase lamb consumption in the United States.

ASI has been working hard for more than two years to inform foreign trade officials at USDA of the association’s concerns with import pressures. Allowing the import of United Kingdom lamb would further add to those issues. The United Kingdom groups have been working hard on trade negotiations, and I am certain lamb is part of that. Lamb production in the country is highly subsidized and they do not allow American lamb entry into their country. We really do not need their lamb here. ASI stakeholders have suggested time and time again that we wish to be on a fair playing field with trade, and it sometimes seems as though that is just not the case.

Y`all keep on doing what you do best and I will see you on down the road.

JULIE STEPANEK SHIFLETT, PH.D.

Juniper Economic Consulting

As the Coronavirus pandemic took hold in America it disrupted lamb processing, eroded strong lamb demand at foodservice and retail, and quickly wiped out about half the value of lamb and wool received by producers. By early June, lamb producers and wool growers were seeing little relief.

Feeder and Slaughter Lamb Prices Weak

Slaughter lamb prices on a comprehensive information basis (combined formula/grid and live, negotiated prices) averaged $212.63 per cwt. on a carcass basis in May, down 19 percent monthly and down 29 percent from a year ago. On a live-weight basis, the average was $106.86 per cwt. Dressed weights were 85 lbs. in May, up 2 percent monthly and up 6 percent from a year ago.

The value of a live lamb in May was about $182 per head, down 25 percent from $242 per head in May 2019. A loss of $60 per head multiplied by the reduced number of lambs harvested in May 2020 of nearly 6,000 head compared to May 2019, brought the total loss to American sheep producers to $342,000 in one month.

The three-market feeder lamb price average at auction was $170.85 per cwt. in May, about steady with April and down 3 percent year-on-year. Feeder lamb prices across Colorado, South Dakota and Texas auctions represent a narrow feeder lamb market, however. Many feeders are currently sold direct from producer to feedlot and many trades do not get reported.

Meat Market Weakens

Lamb prices were quick to drop in March and April as COVID-19 spread; however, it was not until late April and May that wholesale prices began to weaken. The wholesale lamb composite averaged $410.66 per cwt. in May, down 5 percent monthly and up 5 percent from a year ago.

The 8-rib rack, medium, averaged $859.50 per cwt. in May, down 3 percent monthly. The shoulder, square-cut, was down

2 percent from April at $331.73 per cwt. The loin, trimmed 4×4, averaged $477.84 per cwt., down 8 percent monthly. The leg, trotter-off, averaged $388.10 per cwt. in May, down 1 percent monthly.

Primals remained mixed compared to a year ago. The shoulder held strong in May, up 13 percent year-on-year. By comparison, the loin was down 9 percent compared to a year ago. It is believed that the shoulder is a substitute for the loin, providing a versatile, more competitive product alternative. The rack was down 4 percent and the leg was up 2 percent year-on-year. Ground lamb averaged $562.91 per cwt., down 2 percent monthly and down 2 percent year-on-year.

American pelts faced a pre-COVID structural weakening due in part to a reduced demand amid the rise of synthetics, and remained depressed through May. Unshorn supreme pelt prices ranged from -$3.00 to $1.00 per piece in May, about 10 percent higher than April and down 150 percent from a year ago. Premium pelts ranged from -$3.00 to -$0.75 per pelt in May, about steady with April and down 275 percent year-on-year.

Wholesale prices softened in May and June with retail lamb prices following suit. The rack at retail was down 26 percent monthly to $11.22 per lb.; the loin was down 7 percent to $8.56 per lb.; shoulder blade chops averaged $5.64 per lb., down 2 percent in May following a 3-percent drop in April. Ground lamb was $5.66 per lb. in May, down 6 percent monthly. Retail prices are a survey of advertised prices in major retail grocery stores.

Lamb Packer Margins Hit Record High

In recent months, meat at grocery stores cost more for the consumers, but meat processors were paying less for live animals. The American meat packing sector is facing renewed scrutiny for high margins and relatively lower prices paid to livestock suppliers. The issue is facing federal scrutiny and is a public relations challenge for meat companies that warrants a closer look.

The packer gross margin hit a record high in May. Live lamb prices were sharply below May 2019 levels; however, meat values remained higher year-on-year. Packer gross margins are defined by revenue derived from meat, hide and offal sales, less the cost of a live lamb. In May, the price spread between slaughter lamb prices and the wholesale composite (measured by the cutout) was $175 per head, 19 percent higher monthly and 249 percent higher year-on-year.

The margin increased because while the value of meat weakened some, the loss in the value of live lambs was more pronounced. The value of the carcass, pelt and drop credit was $355.99 per head in May, down 3 percent monthly and up 8 percent from a year ago. By contrast, the value of the live lamb (live-equivalent of formula/grid price) was $181.06 per cwt., down 17 percent in May and down

35 percent year-on-year.

The packer margin doesn’t account for packers’ costs such as labor, processing, packaging and marketing. Perhaps most important, the margin doesn’t report the amount of lamb that actually sells. It is possible that a lot of lamb harvested in April and May didn’t sell, and was put into freezers. In early June, 37.9 million lbs. of lamb and mutton were reported in cold storage, up 1 percent monthly and down 8 percent from a year ago. The higher margin might also be explained by higher costs facing packers, including COVID-19 compliance.

The lamb industry is heavily dependent upon foodservice sales, so packers might have to invest in new packaging costs and marketing efforts to pivot to retail sales.

What’s Ahead?

Foodservice sales are likely to remain sluggish under social distancing recommendations. Product will build up, so it will either be put in freezers – a cost to the packer, and a short-term solution – or sold at a deep discount. Marketing will have to get creative. Lamb cuts that are retail- and eat-at-home friendly will likely see some movement.

American lamb will face continued competition from imports at retail. American lamb at retail holds about a 30-percent price premium over Australian lamb, and that premium increased in recent months. In the first quarter, Australian lamb imports at wholesale saw prices fall 2 to 3 percent between quarters, depending upon cut, while American meat prices were steady to 7 percent higher.

As social distancing eases in the third quarter (hopefully), meat spending might be subdued and consumer confidence in the meat complex shaky. Recent disruptions in meat supplies, falling producer prices and concurrent rising retail prices point to potential market inefficiencies.

Richard Curtain, director of the Surveys of Consumers at the University of Michigan, borrowed from Adam Smith in stating that the “current pandemic highlighted the basic mismatch between the current economic policy dependency on growth and market efficiency and the new emphasis on equity,” (5/8/20).

Senator Chuck Grassley (Iowa) questioned meat market efficiency, “When you have three or four meat packers supplying 75 percent of the market, there is reason to question whether the marketplace is working,” (FOX News, 5/27/20).

Domestic Production Down

COVID-19 prompted lamb harvest disruptions and thus slowed lamb harvest in recent months. In January through May, estimated lamb harvest was 759,716 head, down 8 percent year-on-year. Estimated lamb production was 36.9 million lbs., down 11 percent year-on-year. In late March and April, lamb and mutton harvest was down an average 22 percent weekly compared to a year ago. Harvest rebounded somewhat in May, but was still down 4 percent per week year-on-year.

As of this writing, the lamb industry appeared to keep harvest current to avoid overfat lambs. Reduced feedlot inventory helped, although it is uncertain how many lambs remain out in pastures. In early June, the number of lambs in Colorado feedlots – a proxy for live lamb availability nationally – was 81,433 head, 94 percent of last June’s volume and 81 percent of June’s five-year average.

In the first trimester of the year, lamb imports were down 14 percent year-on-year to 79.5 million lbs. Australian imports were down 12 percent in this period to 59.2 million lbs. and New Zealand imports were down 21 percent to 19.1 million lbs. Australian imports were down 22 percent in April compared to April 2019.

Domestic American lamb production and lamb imports brought total available lamb supplies to 124.5 million lbs. in the first quarter, down 13 percent year-on-year.

American Wool Prices Sharply Lower

The American wool industry held wool auctions in May – the first of the season – which attracted a lower volume than last year, and brought sharply lower prices. In May, 688,893 lbs. of confirmed wool trades were reported by the U.S. Department of Agriculture’s Agricultural Marketing Service – 16 percent lower than last May.

The major American wool buyers were present in the wool markets this May, with several of the buyers also likely buying for international accounts in China and Europe.

On average, clean wool prices in the West were about 50 percent lower than a year ago for the finer micron wools and up to 60 percent lower for the mid-micron (24 through 27) wools. Prices ranged from $3.64 per lbs. for 18 micron down to $1.45 per lb. clean for 27 micron.

In the Midwest, May wool prices were 51 to 60 percent lower than a year ago. Prices ranged from $3.09 per lb. clean for 20 micron to $2.05 per lbs. for 24 micron.

In Texas and New Mexico, prices were comparable to other parts of the country. The wools out of this region were largely lower quality wools, which helps explain the lower price for typically some of the finest wools in America. The higher quality wools received 80 to 90 percent of Australian wool prices while the inferior wools brought about 75 percent of Australian wool prices. Inferior wools typically are lower yielding and lack length and strength. Nineteen micron averaged $3.80 per lb. clean and 22 micron saw $3.46 per lb. clean.

In the first week of June, the Australian Eastern Market Indicator was Australian 1,183 cents per kg clean, up 0.3 percent from May and down 37 percent from a year ago. In U.S. dollars, the EMI was $3.72 per lb. clean, up 7 percent from May and down 37 percent year-on-year. The early June lift in the EMI in U.S. dollars was due the Australian dollar appreciating against the U.S. dollar.

Reduced wool supplies at Australian auctions helped support prices.

“Competition, predominantly from Chinese interests, was more active across all types in a very small national offering,” (The Schneider Group, 6/4/20). Looking forward, Chinese raw wool demand is severely dampened, with many mills operating at less than 50 percent (WoolNews.net, 6/2020). Furthermore, Chinese reports revealed that it expects demand for apparel wool to be down by more than 30 percent this year.

American wool exports were down sharply year-on-year in the first six months of its 2019-20 season through March. Greasy wool exports were down 27 percent year-on-year to 1.0 million lbs. clean.

The coming months could be tough for the American wool industry. The American and global economies face economic recessions with sharp reductions in consumer spending. As cold-season fashions are rolled out this fall, it is possible economies will be recovering, albeit very slowly. However, it is also forecasted that COVID-19 sees a resurgences, delaying economic growth.

Wool buyers agree that producers are turning out an incredible American wool clip this year. Too bad it’s 2020. Continuing fallout from the United States-China trade war and the COVID-19 pandemic have created what ASI Deputy Director Rita Samuelson calls a “double whammy,” and it’s clobbering the market for American wool.

“We could kind of deal with the 10 percent tariff with China, but after it increased to 25 percent, that made things pretty unbearable,” Samuelson said during a wool marketing webinar put on by the University of Wyoming Extension in late May. “Then COVID-19 happened. Wool prices are down 42 percent from last year.”

Despite the COVID-19 pandemic, shearers managed to stay mostly on schedule this spring as American wool producers turned out “the best wools ever,” according to Larry Prager at Center of the Nation Wool. Prager cited yields of 65 percent and good color as reasons for the claim, but added that many producers will still need to be prepared to store their wool in 2020. In some cases, they’ll simply add it to the 2019 clip – much of which went unsold due to the trade war.

While prices are down, recent wool sales have proven an age-old adage: there’s almost always a market for well-prepared, fine wool. Coarser wools and those with defects can struggle to find a market, and that hasn’t changed in these difficult times. Producers don’t have to look any further than recent sales at Roswell Wool and Utah Wool Marketing for proof.

Will Griggs of Utah Wool Marketing reported that 70 percent of the wool at his sale on May 21 was purchased. Prices were down

45 percent for fine wools and as much as 65 percent for coarser wools. And he had to stop the sale when he got to the least-desirable selections.

A week later, Roswell Wool held a sale with similar results. Wool under 25 micron brought multiple bids and sold for 85 to 90 percent of Australian wool prices – a competitive percentage of the Australian wool price considering market demand.

“I could have sold even more of the good-quality, well-prepared wools,” said Mike Corn of Roswell Wool. “Wools with issues had very little interest and we stopped the sale because of a lack of bidding.”

Bruce Barker with Great Plains Wool said he’s had little trouble moving anything 24 micron or finer. Producers weren’t always thrilled with the price, but it was still selling. Dave Rowe at Mid-States Wool Growers in Ohio and Dr. Ronald Pope at Producers Marketing Cooperative in Texas, reported similar scenarios. Pope mentioned that there do seem to be opportunities to sell more wool domestically at the moment, so that might be one bright spot for producers.

With so much of the world – including manufacturing – shut down due to the COVID-19 pandemic this spring, the demand for wool certainly slumped. Other fibers such as cotton and polyester suffered similar falloffs with the loss of manufacturing. And there’s added concern that even as the world re-opens, consumers might not be in a hurry to re-open their checkbooks.

“In a regular year, we’ve had sold all of our wool and written everyone checks by now,” Prager said. “But this isn’t even close to a regular year. It’s tough for the producers. When you’ve brought the best looking wool you’ve ever shorn to the warehouse, it’s hard to take less money. It just is. But that’s where we’re at for most producers this year.”

The only option other than selling for less money is to sit on the wool and hope prices improve. But the wool buyers who participated in the webinar agreed that producers might have to hold their wool clip until at least this fall and possibly next spring before prices improve dramatically.

“How long before it gets better,” Prager asked? “That’s a good question. But I don’t have a good answer.”

Storing wool is always an option, but sellers might also face a negative perception of their stored wool.

“My buyers were a lot more interested in the 2020 wool than the 2019 wool,” Griggs said of his recent sale, adding that the soft demand might have been more about the wool quality than the year it was produced. “It was fall-shorn Idaho wool, 24 to 26 micron.”

Whatever the reason, older wool might face price discrimination when it comes time to sell. Even if that’s not the case, the million-dollar question right now is will prices rise enough in the months or years to come to make the wool clip worth holding on to?

“We’re not going to see any huge increases in the next month or two,” Barker said. “There’s too much wool already out there that can still be purchased.”

Griggs said each producer will have to look at his or her situation to make the decision on selling or waiting.

“The bottom line is if you’re in financial need, then sell the wool,” he said. “It’s going to take a while for prices to recover.”

In conversations with producers, Prager said he heard two basic trains of thought on the decision to sell. One group were producers who couldn’t afford to go without a wool check, and the other were producers who couldn’t afford to take half a wool check.

In these uncertain times, one thing is for sure, producers will need to go the extra mile to prepare their wools for sale if they want to attract buyers.

“We have to expect some changes because the demand is changing,” Samuelson said of the 2020 wool market. “We’re looking at other customers besides China. Egypt is an important market, but there just hasn’t been much demand there or anywhere else thanks to COVID-19.”

ASI reminds wool producers that times like these are why the Marketing Assistance Loan and Loan Deficiency Program were created by the U.S. Department of Agriculture. Wool is also eligible for payments under the Coronavirus Food Assistance Program.

“The intent of these programs is to provide cash to carry producers through to a better time to sell their wool,” Samuelson said.

Learn more at your local Farm Service Agency office.

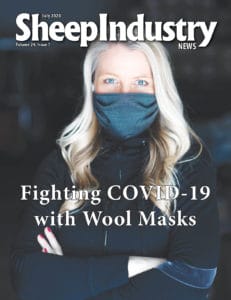

As the United States returns to a new normal this summer, there’s a growing possibility that masks will become common attire for years to come for American shoppers, as well as anyone attending large-scale events or spending multiple hours with strangers in enclosed spaces.

Masks are a common, daily accessory in many Asian countries as inhabitants look to counter the effects of airborne pollution. And they continue to play a key role in battling the COVID-19 pandemic all around the world. With researchers still working to develop a vaccine, face masks have proven effective at preventing the spread of a disease that has killed more than 115,000 (and counting) Americans in the past six months.

Three American wool companies have stepped up to meet the demand for masks, anticipating that consumers will want a more natural, durable option as the wearing of masks is advised for the long term. Bollman, Rambler’s Way and Mountain Meadow Wool are now offering consumer mask options that incorporate all-natural American wool.

At a time when consumers might not be looking to invest in luxury clothing, the masks offer a way for wool companies to continue manufacturing while presenting consumers with an inexpensive item that in some situations they are required to wear. Disposable masks might have been a good, short-term option, but durable, washable American wool masks will pay for themselves time and again over the long haul.

As the COVID-19 pandemic took hold in the United States this spring, masks weren’t always easy to come by. Many consumers found themselves buying homemade options from neighborhood sewers. Fortunately, commercial mask production is now in high gear and consumers have a variety of options to choose from. And that’s important as the Centers for Disease Control continue to recommend the use of face coverings as a way to control spread of the disease.

Producing wool face masks allowed Bollman – the oldest hat factory in America – to get its Pennsylvania factory back up and running during a statewide shutdown that began on March 19.

“Our first thought was to try and get our people back to work, and this was something we could do as mask making was considered essential under the Pennsylvania stay at home order,” said Bollman Chief Executive Officer Don Rongione. “What we determined was that masks made out of wool – wool felt, specifically – had some very strong properties that would really provide for our community and the need in our country.”

After early testing, it was determined that wool that had made it through processing to the hat body stage was the best option. And that was great news for Bollman as it had an excess of factory seconds that would never be made into finished hats.

Not content to produce just a standard face covering, Bollman put its masks to the test through a lab in Utah and they have been proven to provide more than 99 percent bacteria filtration efficiency, more than 98 percent particle filtration efficiency at 1 micron, passed ASTM Level 1 synthetic blood penetration testing and in flammability testing they did not ignite.

The masks can be washed but shouldn’t be dried. Additional sanitizing can be achieved by baking the masks in an overn at 175 degrees for 30 minutes, according to Bollman’s Sarah Friedman.

“It comes out great,” she said. “It doesn’t curl or anything. I’ll do that about once a week, and I wash mine every 10 days or so.”

While Bollman is specifically a hat maker, the company has introduced programs to provide masks with the purchase of hats from it’s Bailey and Kangol brands. Or consumers can buy masks for $19.95 at the company’s website, hats.com.

“I think we are reaching some people who might not have worn wool before, and most have said that yes it is really soft and comfortable to wear,” Rongione said. “In fairness, the wool mask that we make is probably not well-suited for summer wear. It’s a great mask when it’s kind of cool outside.”

Rambler’s Way offers a wool/cotton mask. The exterior is made from 100 percent Rambouillet-Merino wool, while the inside is constructed with cotton.

Like the Bollman mask, a key selling point is that the wool is naturally fire-retardant.

“The Oklahoma Forest Service came to us specifically because they were looking for fire-retardant masks,” said Rambler’s Way Marketing Director Chris Chappell. “Getting people to wear wool next to skin can definitely be an uphill battle. I’ve been saying for years that we need an entry-level product like socks or scarves. These masks aren’t exposing customers to our core product, but it will help them to see the craftsmanship and the quality that comes with buying something made from domestic Rambouillet wool.”

The company’s masks are available for $20 at RamblersWay.com.

Both Bollman and Rambler’s Way can also accommodate bulk orders for large groups.

It’s hard to look into the crystal ball and see what might happen this fall, but there’s plenty of evidence that masks help slow the spread of the coronavirus,” Chappell said. “I think there’s a good chance the need for masks isn’t going to go away anytime soon.”

ASI filed comments on June 11 after the U.S. Department of Agriculture requested additional information on commodities not covered in the original Coronavirus Food Assistance Program. In comments from ASI President Benny Cox of Texas, ASI requested that replacement and slaughter ewes be deemed as eligible commodities under the CFAP program.

“The American sheep industry appreciates the inclusion of lambs and yearlings (2 years and younger) and wool as eligible commodities under CFAP,” Cox wrote. “This has provided a level of much needed relief to a vast number of producers who experienced significant price declines and additional marketing costs due to the impacts of COVID-19 on the lamb and wool markets this year. However, sheep producers have also experienced COVID-19 induced losses of more than 5 percent for both replacement ewes and slaughter ewes during the mid-January to mid-April 2020 period.

“The COVID-19 pandemic severely damaged food service sales and consumer demand for American lamb as food service dine-in sales account for more than 50 percent of the value of American lamb. Processing plants drastically reduced or suspended slaughter operations and the second largest American lamb processing company filed for Chapter 11 bankruptcy. The overall impact resulted in substantial declines in slaughter and feeder lamb prices. These price declines have even greater impacts on the breeding sheep sector due to the loss in the value of the sheep flock. Slaughter ewes sold for less than pre-COVID-19 expectations which is another source of loss to sheep producers. The financial losses incurred by sheep producers and the economic impacts of this pandemic will have long-term implications on the sustainability of the American sheep industry.

“USDA’s Agricultural Marketing Service reports replacement ewe prices on a weekly and monthly basis. The weekly replacement ewe price data is reported in the state auction market reports with the monthly data derived from these weekly reports. Replacement ewe prices have been reported by auction markets in both April and May. However, the monthly report has been absent of prices during this time. Therefore, the sheep industry has had to rely on weekly auction market prices to assess the damage of the pandemic on replacement ewe prices.

“Since there is not a national weekly replacement ewe price, a three-market average is estimated. This is the approach utilized by the Livestock Marketing Information Center for estimating a national feeder lamb price. The three markets are: Fort Collins, Colo., Sioux Falls, S.D., and San Angelo, Texas. These markets represent the key sheep production regions and are more reliable than other auction reports in that prices are consistently reported each week. The weekly three-market average replacement ewe price for young ewes, age 2 to 4 years old, declined 20 percent from mid-January to mid-April 2020.

“USDA-AMS reports slaughter ewe prices in the weekly auction market reports on a grade basis (e.g. Good, Utility, Cull). Slaughter ewes can be referred to as aged ewes which are 5 to 6 years and older. Slaughter ewes are marketed to a niche consumer market that demands a more mutton-type meat product. This market is not immune to the economic impacts from COVID-19 being experienced by sheep producers and consumers.

“Like replacement ewes, there is not a national slaughter ewe price reported by UDSA-AMS. Therefore, the LMIC three-market average approach for the same markets (Fort Collins, Sioux Falls and San Angelo), is applied for slaughter ewes. The most utilized and consistent price series for these three markets is slaughter ewes graded good 2-3. From mid-January to mid-April 2020, the weekly three-market average slaughter ewe price declined 16 percent.”

But that wasn’t the only issue addressed in ASI’s comments.

“We take this opportunity to provide additional comments for consideration regarding the CFAP for lambs/yearlings and wool. While recognizing the limitations of the program, the one-quarter of production from mid-January to mid-April does not accurately capture the full extent of the COVID-19 price declines and resulting impact on producer losses. The impacts of COVID-19 on the lamb market were prolonged well into May and continue to weigh on the American sheep industry.

“In late May, prices for slaughter lambs and yearlings had fallen to levels not seen in over a decade. Many producers did not have the opportunity to sell lambs and yearlings until after the mid-April date. As a result, these producers who experienced the worst of the price declines due to COVID-19 are not being fully compensated for their losses.

“Regarding wool, the production time period does not align well with the shearing season. The sheep shearing season continues well into May and June. For many sheep producers, particularly those located in the intermountain west, the mid-April date precludes many sheep producers being able to apply for assistance using their 2020 wool inventory and therefore are not being fully compensated for the losses on their wool clip due to COVID-19.”

Comments on the USDA request for information were due in by June 22.

The Association of Public and Land-Grant Universities and the Association of American Veterinary Medical Colleges announced in June the creation of a Gene Editing Task Force. Recognizing the potential for gene editing to increase food security and safety, the 11-person panel is comprised of scientists and industry leaders who will map out recommendations for regulating this emerging genomic technology in animal agriculture with appropriate safeguards and procedures.

The need for a task force was born out of a September 2019 symposium – Gene Editing in Livestock: Looking to the Future – which the two associations organized. During that event, 23 of the nation’s leading experts from academia, government, industry and professional groups gathered to examine a series of questions ranging from the nature and safety of this promising technology to its ethical implications.

Symposium participants concluded that work with animal and plant genomes has vast potential for limiting disease and increasing productivity, but agreed that appropriate regulatory processes should be thoroughly considered and structured. Currently the Food and Drug Administration regulates genetic work on food animals as an “animal drug” and the U.S. Department of Agriculture regulates these technologies with crops.

“This is a very promising area of biotechnology that has the potential to unleash enormous progress in terms of food production and security,” said Dr. Noelle Cockett, President of Utah State University, a renowned geneticist and friend to the American sheep industry, who is leading the task force. “Last fall’s symposium featured a series of presentations and discussions which identified and explored important questions and implications related to this emerging technology. These need to be thoughtfully considered and transformed into policy and regulatory recommendations. That’s the goal of this task force.”

To develop a task force, the AAVMC and APLU established a steering committee, which put out a call for nominations. That steering committee selected six people from academia to serve on the task force: Dr. Jon Oatley, Washington State University; Dr. Bhanu Telugu, Virginia-Maryland College of Veterinary Medicine; Dr. Londa Nwadike, University of Missouri; Dr. Jonathan Beever, University of Tennessee; Dr. Rex Dunham, Auburn University; and Dr. James Murray, University of California-Davis.

The task force will also include Dr. Andrew Rowan, Wellbeing International; Dr. Kathy Simmons, National Cattlemen’s Beef Association; Clint Nesbitt, Biotechnology Innovation Organization; and an as yet unnamed liaison to the Center for Food Integrity. The task force will be chaired by Dr. Cockett.

“The potential for gene editing to dramatically boost food security globally and reduce the burden on natural resources is enormous, but it must be done carefully and ethically,” APLU President Peter McPherson said. “We are very pleased to partner with AAVMC on this task force, which is bringing together some of the foremost leaders in the world to help recommend a path for government to take to regulate this field in a way that protects all involved while allowing the science to flourish.”

The task force was expected to conduct its first virtual meeting in June, and in-person meetings will be held following the relaxation of pandemic-induced social distancing protocols.

The APLU and the AAVMC decided to take action in this area following inquiries from members of Congress to Food and Drug Administration Acting Commissioner Norman E. Sharpless concerning current regulatory processes. That provided the impetus for the AAVMC and the APLU to organize the fall 2019 symposium for leading scientists and other scholars.

“The symposium we presented last fall in partnership with APLU was a big step forward in a very important process,” said AAVMC CEO Dr. Andrew T. Maccabe. “We’re very grateful to the group of respected experts who have agreed to help us move this project forward. We’re also pleased to have the opportunity to collaborate with APLU on a large scale program that has such vast implications for agricultural productivity and disease prevention.”

Discussions and presentations held during the September 2019 day-and-a-half conference explored different facets of the gene-editing issue from a public policy perspective. Conference sessions included science and research, industry perspective, bioethics, public policy and regulation, and communication and public engagement.

The APLU and the AAVMC previously teamed up on a multi-year effort designed to address the growing antimicrobial resistance problem. That led to the establishment of the National Institute of Antimicrobial Resistance Research and Education, which is based at Iowa State University and operates in collaboration with a consortium of partner universities and medical institutions.

CALIFORNIA

CWGA NAMES NEW EXECUTIVE DIRECTOR

Jay Wilson brings a lifetime of sheep industry experience to his new/old role as executive director of the California Wool Growers Association. He previously served in the position from 1987 to 1997.

Wilson grew up on a sheep operation in Utah, where his father, Vern Wilson, served as president of the Utah Wool Growers Association in the 1970s. From the ranch, Wilson went on to earn a degree in political science and business administration from Utah State University. He served as interim director of the National Wool Growers Association before the merger that created ASI. His involvement with that group introduced him to many state association leaders and led to his first stint in California.

He left CWGA to serve as executive director of the National Sheep Industry Improvement Center, and also worked to transition the family ranch to the next generation.

After several years out of the sheep industry, Wilson heard from several producers about the California opening.

“It’s a good fit,” Wilson said. “I truly love the sheep producers in the state of California, and even when I was working in Washington, D.C., I was always coming back to the state for weddings and funerals. This is just a great bunch of people to work with.”

IDAHO

ASSOCIATION HIRES GOVERNMENT AFFAIRS MANAGER

The Idaho Wool Growers Association has hired Caleb Pirc as its government affairs manager, a new position for the Boise-based nonprofit.

Executive Director Naomi Gordon and Board President John Noh said the move is part of IWGA’s growth plan as well as a desire to work with Pirc, whom they met nine months ago and subsequently enlisted to help host a class.

“I just remember his excitement about sheep,” said Noh, a large-scale producer based near Kimberly, Idaho.

Pirc, 20, started in the currently part-time post on June 1. He owns and operates Meridian, Idaho-based sheep producer Good Shepherd Farm. He is completing a bachelor’s degree in business administration-entrepreneurship and plans to pursue a master’s degree in public policy, both through Liberty University.

Gordon said the dues-funded association aims to add to staff, now three, as membership increases. Pirc will focus on IWGA policy and advocacy.

“A lot of the work will be making sure the industry is represented, helping to protect it on the regulatory-policy front and making sure producers have a chance to succeed,” Pirc said. “I’m very excited. I think the industry has a lot of potential.”

Source: Capital Press

MONTANA

PRODUCER NAMED TO LIVESTOCK BOARD

Gov. Steve Bullock has made two new appointments to complete the seven-member Montana Board of Livestock.

The governor’s office announced that Gilles Stockton of Grass Range, Mont., has been appointed to represent the sheep industry on the board, filling the position previously held by John Lehfeldt of Lavina, Mont. Wendy Palmer of Raynesford, Mont., has been appointed as a cattle industry representative on the board, to replace John Scully of Ennis, Mont.

Until his resignation last year, John Lehfeldt was appointed by the governor to serve as chairman of the board. In his stead, John Scully had been serving as acting chairman for the past several months. Bullock has appointed Brett DeBruycker to serve as the new chairman.

The make-up of the Board is currently as follows: chairman Brett DeBruycker, cattle; Gilles Stockton, sheep; Nina Baucus, cattle; Susan Brown, dairy/poultry; Wendy Palmer, cattle; Lila Taylor, cattle; Ed Waldner, swine.

In other management changes, the board approved Ethan Wilfore to the position of brands administrator, which means he will head the department’s brands enforcement division.

To learn more, visit Liv.mt.gov/Home/Board-of-Livestock.

DALE LUNDGREN, 1942-2020

Dale H. Lundgren passed away Wednesday, May 27, 2020, in a tragic farm accident at the ranch.

He was born March 22, 1942, in Sturgis, S.D., to Carl and Jennie (Septka) Lundgren. Dale attended school in Sturgis and then attended Black Hills State College, receiving his bachelor of science in education in 1969. He was in the National Guard for 12 years and belonged to the Iron Workers Union for a number of years.

Dale married Janice (Jordan) Lundgren on Sept. 1, 1967. They lived in Sturgis while he attended college, worked iron and helped his dad on the ranch. Janice and Dale moved to the home ranch in April of 1972, where they have resided ever since.

They primarily raised sheep and Dale was active in the sheep growers associations, both on the state and national level. Dale loved flying and did a great deal of predator control work from his twin-engine Super Cub. A great many friends, trips and fond memories were made from these activities.

Dale and Janice sold their sheep in 2014, but Dale continued putting up hay at 9-Mile and selling it. He always had to have something to do.

He was also active in the Elk Creek Conservation District on the local and state level. He was passionate about conservation and the good that could be done to the land.

Dale loved going to the Sturgis Community Center. The hot tub was his favorite spot. It helped his arthritis and circulation, but more importantly, he loved to socialize there. He loved visiting with people of all ages.

Therefore, his memorial will be the Sturgis Community Center Scholarship Fund. He would want all kids to be able to take advantage of those opportunities.

His latest enjoyment had been the crib tournaments in Sturgis. He loved to play crib, as did his father before him. Dale and Janice would play a game of crib almost every morning. He also played crib with his daughter, Lori, in Kansas via Facebook and Skype so they could keep in close contact.

Dale is survived by his wife, Janice; daughters, Lori (Tim) Zeigenbein, Erie, Kan., Rebecca (James) Burke, Salem, Ore., and Keri (Kwame) Kinabo, Portland, Ore.; grandchildren, Erin Martha Burke and Akii Kwame Kinabo; brother, Carl (Mavis) Lundgren; sisters, Rowena Koko Wier, Vaunda (Merrill) Jorgenson, and Cheryl Joy Jacobson; and numerous nieces and nephews.

He was preceded in death by his parents; brother, Merland Kampa; sister, Barbara Heimbuck; and sister, Wanda Mosley.

A memorial has been established to the Sturgis Community Center Scholarship Fund.